Roku: More Than a Streaming Service

Spearheading digital media by day and front-running programmatic advertising by night.

In this issue, we will be covering Roku’s:

Background

Management

Operations

Roku Player

Roku Platform

The Roku Channel

Advertising & Publishing

Acquisitions & Partnerships

Financials

Competition

Critics

Points of Emphasis

Let’s jump into it.

1. Background

Roku is a digital media player that offers their customers a wide variety of digital media content from a vast array of streaming services. There are far too many services available on Roku to name them all, but popular services include Netflix, Hulu, ESPN+, Disney+, HBO Max, STARZ, Peacock, YouTube, Amazon Prime Video, and many more.

Roku was founded in 2002 in a collaborative effort with Netflix, but didn’t sell their first over-the-top streaming box, i.e., the Roku Streaming Player, until 2008. The six-year window between the founding and their first product was a result of Netflix’s founder Reed Hastings believing that Netflix would encounter licensing trouble in the future if they manufactured and sold their own streaming player. Thus, Roku spun off of Netflix and produced their products as a solo enterprise.

In 2010, Roku began offering variations of their revolutionary digital media player, with better, more advanced models quickly hitting the shelves. Roku carries this business model with them still today, currently offering many different streaming devices to fit the mold of their consumers and reach all levels of streaming enthusiasts.

Later, in 2014, Roku officially announced the development of RokuTV — smart TVs manufactured by existing TV brands with built-in Roku functionality by running on Roku OS. Rather than build and produce their own TVs, Roku opted to partner with established TV manufacturers to provide smart capabilities to their products.

TV manufacturers that didn’t want to build and maintain their own operating system but wanted/needed smart TV functionality were keen to partner with Roku and run their products on Roku OS. Common TV brands that adopted this strategy include Hisense, TCL, Philips, Sharp, Insignia, and many others.

In essence, this strategy is very comparable to how popular computer manufacturers such as Dell, Lenovo, Asus, Acer, and other operate on Microsoft Windows.

2. Management

Roku was founded in 2002 by Anthony Wood, who previously founded ReplayTV, a digital video recording (DVR) company similar to TiVo. In 2001, ReplayTV was acquired by SONICblue for $121M. After ReplayTV was acquired, Wood worked briefly at Netflix, where he founded Roku. He has served as the CEO of Roku since 2002, Chairman of the Board since 2008, and President since 2011.

Steve Louden joined Roku as the CFO in 2015. Steve began his professional career as a financial analyst for Merrill Lynch before moving on to senior financial roles at Washington Mutual, McKinsey, and Walt Disney. Louden then went on to work for Expedia where he held several different titles throughout his stint there, including Treasurer and Vice President of Corporate Finance.

3. Operations

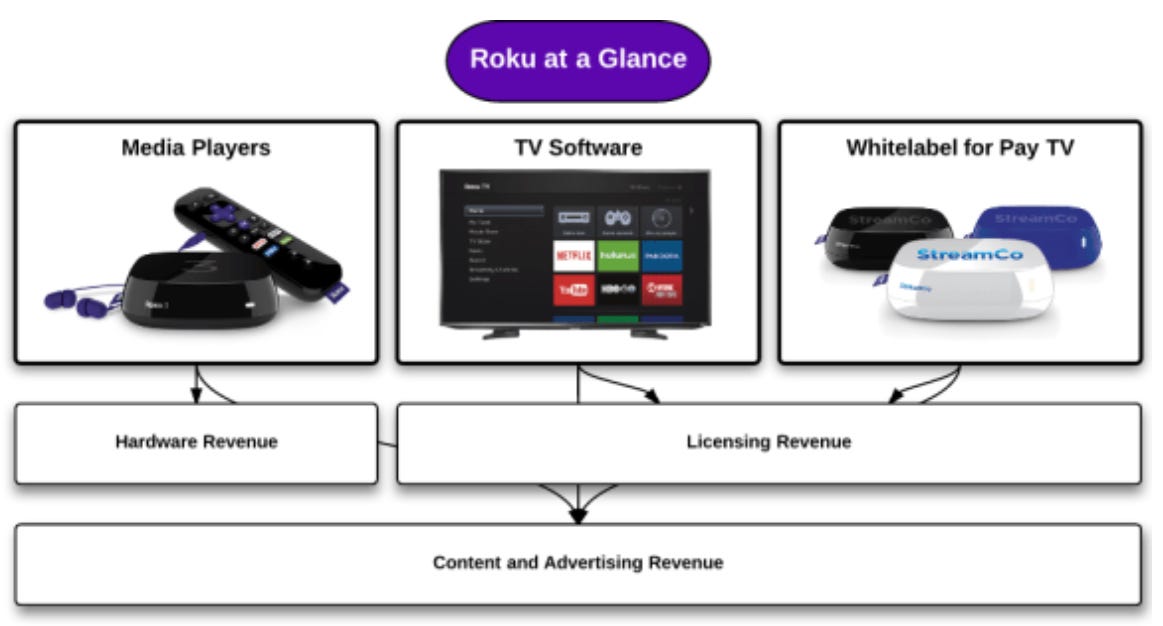

The Roku business strategy is relatively easy to understand:

a) attract as many users to the Roku Platform as possible, through Roku Players (the various streaming devices and RokuTVs)

b) profit off customer engagement and advertisements

To better explain each side of their business, Roku operates through two divisions, which they call Roku Player and Roku Platform.

4. Roku Player

Roku Player is the hardware side of the business, which revolves around their digital media streaming players and their RokuTVs. In essence, the main objective of this side of Roku’s business is to simply attract new customers to Roku Platform, and retain existing users.

Because the media streaming player business as a whole has been experiencing slower growth over the years (currently growing at just about 6% each year), Roku has ramped up their partnerships with TV manufactures in an effort to continue attracting new users to the Roku Platform, which has proved very effective.

By licensing the Roku OS to TV manufactures at an increasing rate, Roku effectively reduces their dependence on their digital media players to attract new customers to their platform.

Because Roku Platform is where Roku really shines, the Roku Player side of the business has a gross margin percentage of just 13.8%, which is by design. The lower margins make it easier for Roku to attract new users to their platform, which is where the growth really begins.

Nevertheless, the revenue from their hardware has still been experiencing consistent growth, though far less substantial than the growth of the Roku Platform. However, more importantly, active accounts on the Roku Platform have been steadily increasing each year, which is a testament to the efficiency of the Roku Players.

Everything is all going according to play for Roku.

I’ll come back with some interesting financials with respect to Roku Players later in this publication. For now, let’s move on and look into the platform side of Roku’s business.

5. Roku Platform

The Roku Platform is the software, data, media, publishing, and advertising side of Roku’s business. The Roku Platform earns revenue through:

a) third-party subscriptions

b) advertisements

c) selling inventory (major advertisement slots) and data to publishers and advertisers

d) deals with TV manufacturers

e) The Roku Channel

Let’s take a look at each revenue stream.

a) Third-Party Subscriptions

Roku earns revenue from directing consumers to third-party subscriptions. For example, let’s say a user subscribes to Netflix by using Roku OS, whether that be through a streaming stick or a RokuTV. Roku then earns a piece of that monthly/yearly subscription each and every time it is renewed.

b) Advertising

Roku currently earns most of their revenue through their unique advertising business.

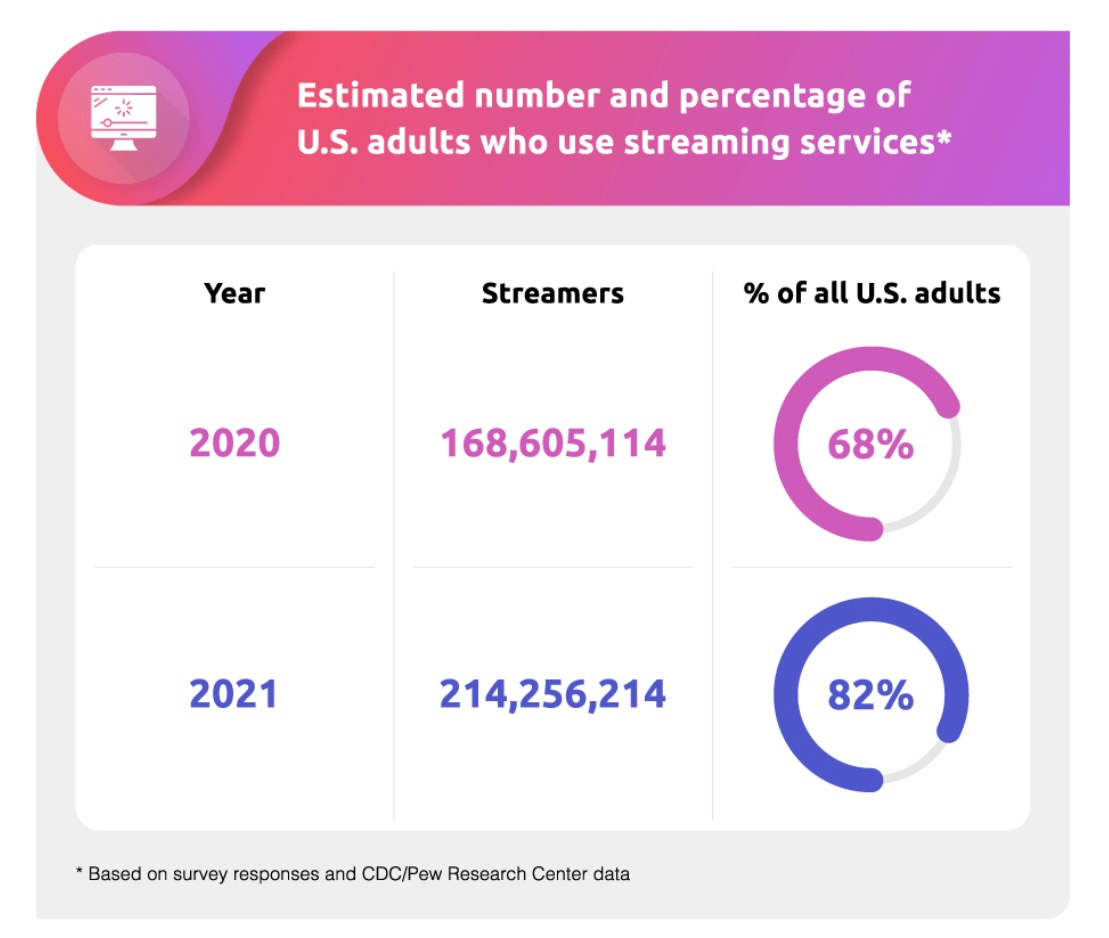

During the pandemic, advertisers noticed the “cord-cutting” shift began accelerating amongst consumers. This means that the typical, leaner TV advertisements were decreasing in effectiveness, reaching less and less consumers and TV watchers.

This prompted more advertisers to shift their focus toward digital advertising formats — Roku’s specialty.

Digital advertising formats are far more effective than linear advertisements, thanks largely to the massive amounts of data that Roku has stored on their Roku OS. Advertisers, after purchasing access to Roku’s unique data technology, are able to precisely target a specific demographic.

For example, Roku knows the consumption percentages behind every show watched on Roku OS. They know which shows are popular amongst specific age groups, genders, at which time of the day is the show most watched, etc.

As one can imagine, this leads to far more sales for the advertisers, who in turn increase their allotted digital advertisement budget, repeating the cycle.

I’ll provide a better look at Roku’s specific advertising techniques shortly, but this was just meant as a subsection for how Roku Platform earns revenue.

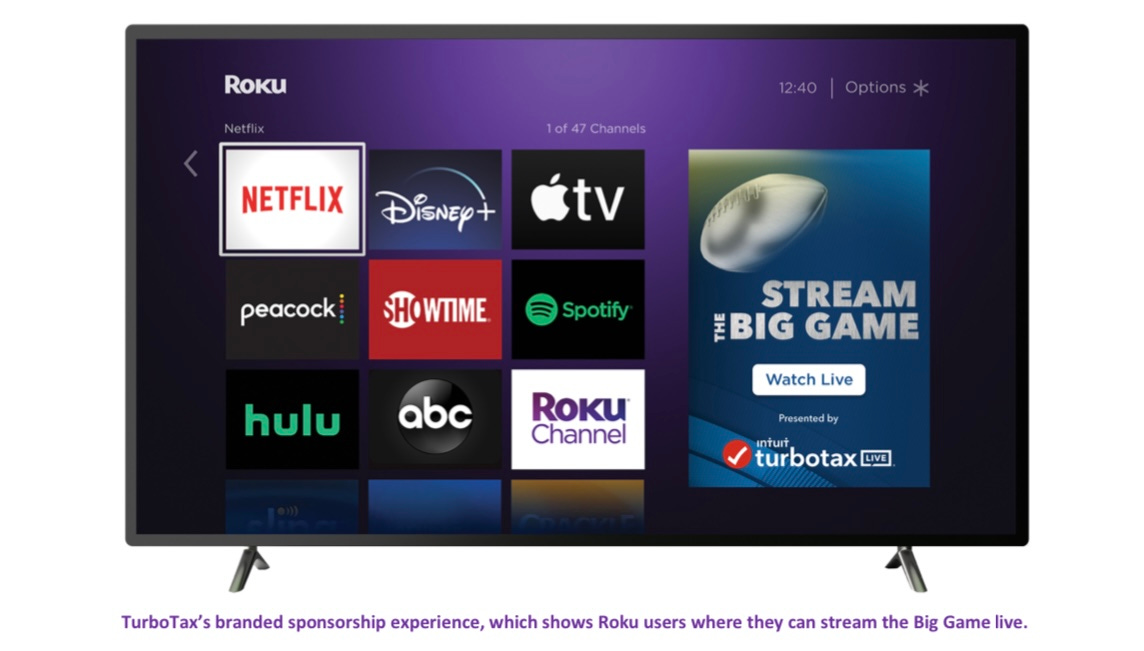

c) Selling Inventory & Data

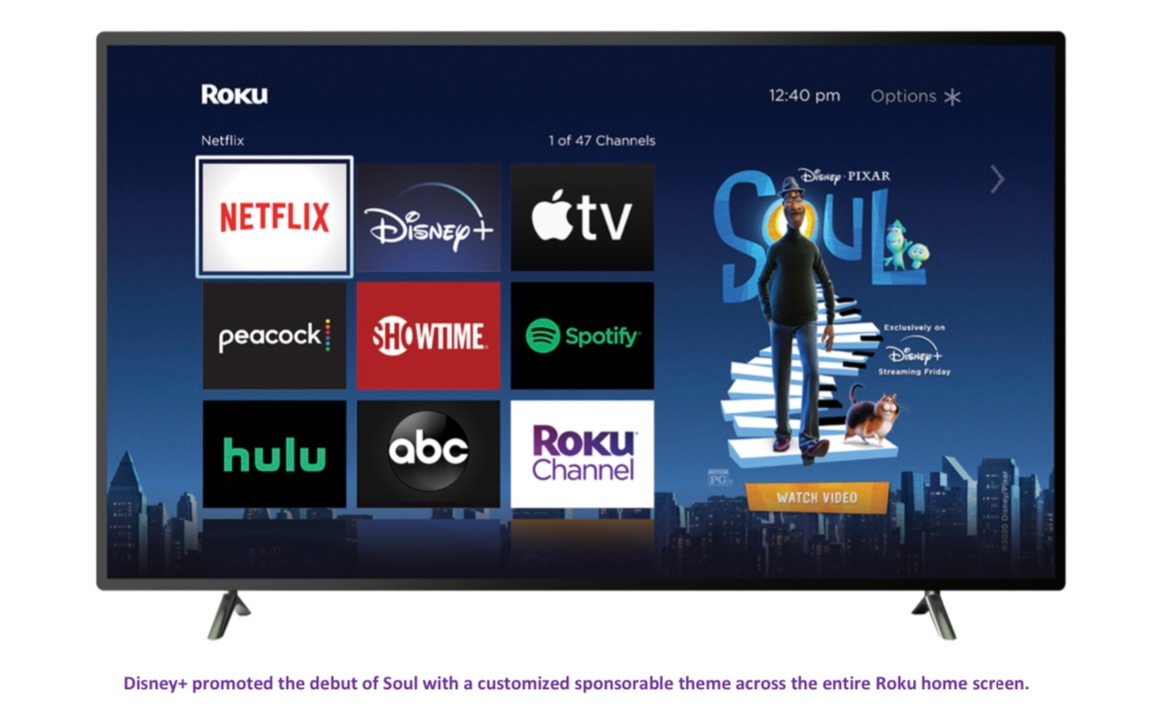

On top of the regular digital advertisements, Roku also sells over-the-top, premier advertisement slots, which top advertisers and publishers purchase, often to promote special events and new releases.

These premier advertisements may be home-screen or background advertisements across all of Roku OS for a given time frame, or may be entire thematic changes, as seen in the examples below.

d) TV Manufacturer Deals

As mentioned earlier, Roku collaborates with TV brands, licensing their Roku OS to the manufacturers.

The deals with the manufacturers themselves are credited to Roku Platform revenue, while commission from product sales (the in-store sales of the RokuTVs) is directed to Roku Player revenue, as it is considered hardware.

Likewise, all revenue earned from consumers after the purchase of the RokuTV is also Roku Platform revenue.

e) The Roku Channel

Again, I’ll keep this excerpt of The Roku Channel short, as I will be expanding upon it later. I just felt it necessary to also include here, like advertisements, as it is a core part of the Roku Platform’s revenue streams.

In the simplest form, The Roku Channel is Roku’s own streaming service, offering hundreds of free movies, shows, and live television channels.

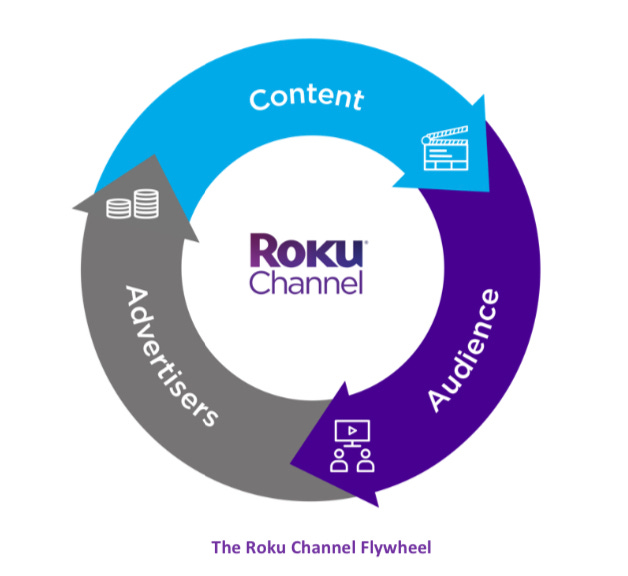

6. The Roku Channel

After the advertising division, The Roku Channel is the brilliance behind Roku. We all know fully well what The Roku Channel is, but many know little about how they operate. In the consumer’s eyes, The Roku Channel is just another streaming service that offers free content; in Roku’s eyes, it is their ticket to negotiations, extended advertisement time, and, ultimately, profit.

In April of 2021, Roku announced that Roku Originals would soon be coming to The Roku Channel — that is, content funded and produced directly by Roku, similar to Netflix or Amazon, Apple, Hulu… the list goes on. That said, this content hasn’t yet been released to The Roku Channel. Instead, the only “Roku Originals” currently on The Roku Channel are short-form media from Quibi, a digital media content company whom Roku acquired the owning rights to all content from. Thus far, all other content on The Roku Channel has been licensed to Roku from other digital media companies, in which Roku often paid for the rights to show. However, lately, Roku has been using The Roku Channel more directly in negotiations with major companies.

Let’s take Peacock, for example; when Roku was in negotiations with Comcast’s NBCUniversal over the addition of the Peacock app to Roku OS, Roku was asking for 30% of advertisement space within the app. Unwilling to part with 30% of advertisement time, NBCUniversal and Roku exchanged lengthy negotiations, which ultimately ended in Roku taking less advertisement time, but obtained programming rights for many of NBC’s past featured films to show on The Roku Channel.

This is Roku’s genius.

With The Roku Channel’s growing popularity, Roku has been able to ask or even demand licensing rights in negotiations — a tactic that will become more powerful with time. The more programming rights Roku obtains, the stronger The Roku Channel becomes, and the more weight Roku will carry in negotiations.

Next, Roku sells dynamic digital advertisements to advertisers on The Roku Channel for a fee and takes commission from each sale through their platform.

So, just to recap, let’s look at the order of operations:

Obtain the rights to license and program feature series, shows, and films from major media companies like NBC, Fox, WarnerMedia, etc.

Use this featured content to add depth to The Roku Channel and build its popularity by advertising their availability to watch for free through in-house advertisement slots within the Roku Platform.

Acquire content through acquisitions, such as Roku’s purchase of Quibi.

Grow The Roku Channel’s relative strength through creating Roku Originals, in which Roku owns all content rights and thus advertisement slots.

Sell advertisement times on The Roku Channel back to major media companies for a premium and profit from sales.

Thus, you can see how The Roku Channel is well positioned for long term success, and how, while it may not seem like it to the eyes of the user, is a critical component to Roku’s exponential growth.

7. Advertising & Publishing

Roku makes money from advertisements in a wide variety of ways. Let’s take a look.

Subscriptions

I touched on this a couple times already, so I won’t bore you with a description here.

Selling Roku Inventory

This includes the home-screen display advertisements that are seen when the Roku device is turned on, as mentioned earlier.

Selling Publishers’ Inventory

This is the first time directly mentioning how Roku profits from publishers’ apps after the deal has been reached to add their app to Roku OS, aside from subscriptions within their app. Rather than take commission from each advertisement on the publisher’s app, Roku instead owns and controls some of the publisher’s advertisement inventory — meaning Roku owns the advertisement slot, in which they can sell to other advertisers or use it to advertise The Roku Channel.

Deals with TV Manufacturers

I also mentioned this earlier and it is relatively self-explanatory as is.

Selling Advertisers & Publishers Data Access

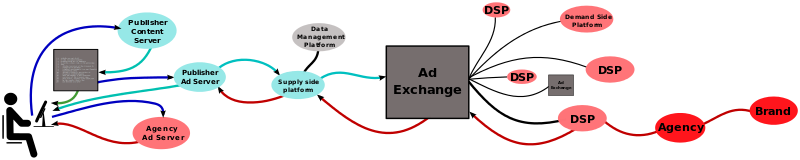

Roku sells publishers and advertisers access to OneView, their data enhanced advertising system that allows marketers to optimize their advertisements and measure their effectiveness through a single, fully integrated demand-side platform (DSP). Importantly, these tools aren’t just available for OTT advertisements, but across linear TV, desktop, and mobile as well, thanks to their dataxu acquisition, which I will get to later on in this essay. Summarizing directly from Roku’s website, the OneView Advertisement Platform offers marketers:

a) Better Identity Solutions

Access more accurate TV audience data powered by Roku’s direct consumer relationships.

b) Deeper Consumer Insights

Plan and measure using unique linear TV data from automatic content recognition on North America’s #1 TV OS.

c) Proprietary Audiences

Activate more than 100 unique segments based on data from the #1 TV streaming platform in the U.S. by hours streamed.

d) Instant OTT Forecasting

Calculate over-the-top advertisement inventory availability in seconds to buy advertising sold by both Roku and by other publishers.

e) In-Flight Attribution Tools

Optimize reach, frequency, and performance across OTT, linear TV, desktop, and mobile campaigns.

f) Guaranteed Outcomes

Guaranteed demographic delivery or business outcomes such as website visits or mobile app downloads.

Channel Recommendations

When setting up their devices, new users are prompted with recommended channels and applications to download to their home-screen. These recommendations come in part by paid placement from publishers.

Sponsored Shows

Occasionally, The Roku Channel will offer special premiers or day/week-long events that may be sponsored by brand ambassadors for a fee and, of course, commission from any sales. For example, here is a home-screen image of Coors Light’s promotion of “Explorers Wanted” on The Roku Channel.

Remote Buttons

If you own a Roku device, I’m sure you’ve noticed the branded buttons at the bottom of newer remotes. Streaming services like Netflix and Hulu will pay Roku for a shortcut button on the Roku remotes that take users directly to their app.

8. Acquisitions & Partnerships

a) Acquisitions

Roku has shown over the years that they are not afraid to risk cash and stock to acquire companies that they think will greatly enhance to Roku ecosystem. Let’s take a look at some of these acquisitions and then break them down:

dataxu

In 2019, Roku acquired dataxu, an advertising technology company for $150M in cash and stock.

Tim Peterson, a contributor for Digiday, an online magazine that specializes in digital content, digital advertising, and digital marketing, wrote that:

In the short term, dataxu’s programmatic buying tool is expected to make it easier for advertisers to buy ads on Roku’s connected TV platform. But in the long run, the combination of dataxu’s programmatic buying tool and data platform will provide Roku with an opportunity to not only seize more control over the ads running on its platform, but also play a role in the ads running elsewhere, according to industry experts.

Nielsen’s Advanced Video Advertising

In March 2021, Roku reached an agreement with Nielsen to acquire Nielsen’s Advanced Video Advertising (AVA) business.

When asked about the Nielsen acquisition, Louqman Parampath, Roku’s VP of Product Management, stated:

Combining Nielsen’s AVA technology with Roku’s innovative ad tech and scale will enable us to deliver the benefits of TV streaming advertising to traditional TV. Roku will bring the promise of DAI to the market for the first time ever at scale — providing better targeting and measurement for advertisers, creating easy integration and additional revenue opportunities for programmers’ ad sales teams, and improving the TV experience for viewers. We’re also excited to become a key strategic partner for Nielsen in their new cross-media measurement products, and jointly drive towards greater transparency and accuracy in TV streaming measurement.

Quibi

Roku acquired all of the content owned by Quibi, a short-form, over-the-top streaming platform meant specifically for mobile devices, in January of 2021 for “less than $100M.”

Rob Holmes, Roku’s VP of Programming, said this regarding the acquisition:

Today’s announcement marks a rare opportunity to acquire compelling original content that features some of the biggest names in entertainment. We’re excited to make this content available to our users in The Roku Channel through an ad-supported model. We are also thrilled to welcome the incredible studios and talented individuals who brought these stories to life and showcase them to our tens of millions of users.

This Old House

In March of 2021, Roku announced that it had acquired This Old House, America’s #1 multi-platform home enthusiast brand. This Old House serves over 20 million consumers monthly with content, information, and advice about home improvement.

Rob Holmes stated this about the acquisition of This Old House:

As the top-rated home improvement programs in America, ‘This Old House’ has the broad appeal that is perfectly suited to support The Roku Channel’s ad-supported growth strategy. This Old House created the television home improvement genre and is beloved by millions of fans. We are thrilled to welcome this incredible team, and we could not be more excited to help grow the brand for an entire new generation of home improvement enthusiasts.

Clearly, Roku has a plan regarding their acquisitions and are aggressively tackling it. Roku tends to acquire businesses that will greatly improve their advertising division by implementing proprietary technology and data analysis, such as Nielsen’s coveted automatic content recognition (ACR) and dynamic advertisement insertion (DAI) technology.

Likewise, the acquisition of dataxu allowed Roku to develop OneView, from which they become a fully integrated demand-side platform (DSP), allowing advertisers to be in full control of multiple advertisement and data exchange accounts all from a single, in-house interface. In other words, DSPs allow advertisers to control inventory, target, serve, bid, and track advertisements, and use proprietary data to optimize efficiency. This effectively eliminates the need for third-party advertisement exchanges, increasing Roku’s revenue and margins.

Additionally, Roku is keen to acquire specific content producers with major audiences that may not be fully tapping into their potential, like Quibi and This Old House. Roku acquires these companies to add content and depth to The Roku Channel while avoiding licensing and programming fees while maintaining sole ownership over advertisement inventory within said content.

b) Partnerships

Roku has partnerships with many, many companies, including TV manufacturers, publishing studios, and advertisement agencies. Media conglomerates are drooling to get a Roku partnership, but Roku won’t be taken advantage of. Roku is known to go through lengthy negotiations with potential partners, in part to make sure Roku gets a good deal, but also to make sure their partners understand Roku’s business and how they can effectively operate within it, securing both parties a profitable venture.

Roku is currently partnered with over 15 different TV manufacturers, many third-party developers, and hundreds of channels and digital media providers.

Roku recently announced that its partnership with Google regarding YouTube TV had fallen through after its contract expiration. Until the dispute is settled, Roku announced that YouTube TV would no longer be available for download within the Roku Platform, but will remain on existing accounts that had already downloaded the app. The YouTube app remains unaffected and is still available for download. Once Roku pulled YouTube TV, Google decided to add a “Go to YouTube TV” button to their YouTube app in an attempt to work around Roku’s changes. Roku held a press release over the matter, in which they claimed Google’s actions are “the clear conduct of an unchecked monopolist bent on crushing fair competition and harming consumer choice.”

9. Financials

The time has finally come — let’s take a peek at some of the numbers that define Roku, showcasing some key areas of growth.

a) Income Statement

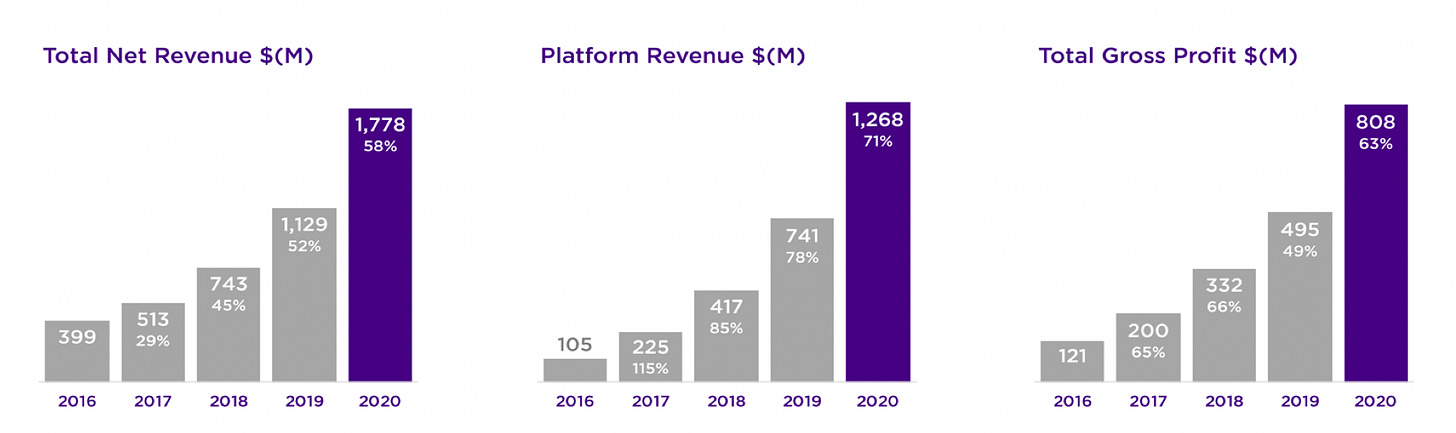

To begin, let’s assess Roku’s revenue. In 2020, Roku’s total net revenue grew to $1.78B, a 58% increase from the year prior. Roku Player accounted for just 29% of the total revenue, coming in at $510M — a 31.6% increase year-over-year. Roku Platform provided the rest (71% of total 2020 revenue), with a revenue of $1.27B, a growth of 71.1% year-over-year. As we can see, while Roku Player revenue certainly isn’t decreasing, it isn’t experiencing anywhere near the growth that the Roku Platform is, as we had discussed earlier.

But, with some give comes a little take — Roku’s cost of revenue continues to increase, as one might expect. In 2020, the Roku Player’s cost of revenue was $467M, up from $371M in 2019. However, Roku Platform experienced a sharper increase in cost of revenue due to how hard they are pushing their products, forming partnerships, and making acquisitions for the advertisement division and for The Roku Channel. Roku Platform’s cost of revenue nearly doubled from the year prior ($263M) to a steep $503M in 2020, and is expected to continue to rise, which is a good sign for the growth of the company.

As a company, Roku’s gross profit for 2020 was $808M, a 63% increase year-over-year from $495 in 2019. Of that $808M, Roku Player contributed $43M, while Roku Platform again carried most of the load, providing the remaining $764M.

I think it is important to note that, as confirmed by Roku’s stellar Q1 2021 earnings report, all three of the aforementioned metrics are growing year-over-year. In Q1 2021, Roku Player’s revenue was $107.7M ($88M in Q1 2020), cost of revenue was $93M ($77M in Q1 2020), and gross profit was $15M (compared to $10M in Q1 2020). Likewise, Roku Platform’s revenue in Q1 2021 was $467M (compared to $233M), cost of revenue was $155M (compared to $102M), and gross profit was $312M (compared to a measly $131M the year prior). Thus, we may conclude that Roku’s revenue, costs, and profits are all steadily increasing, and will likely continue doing so.

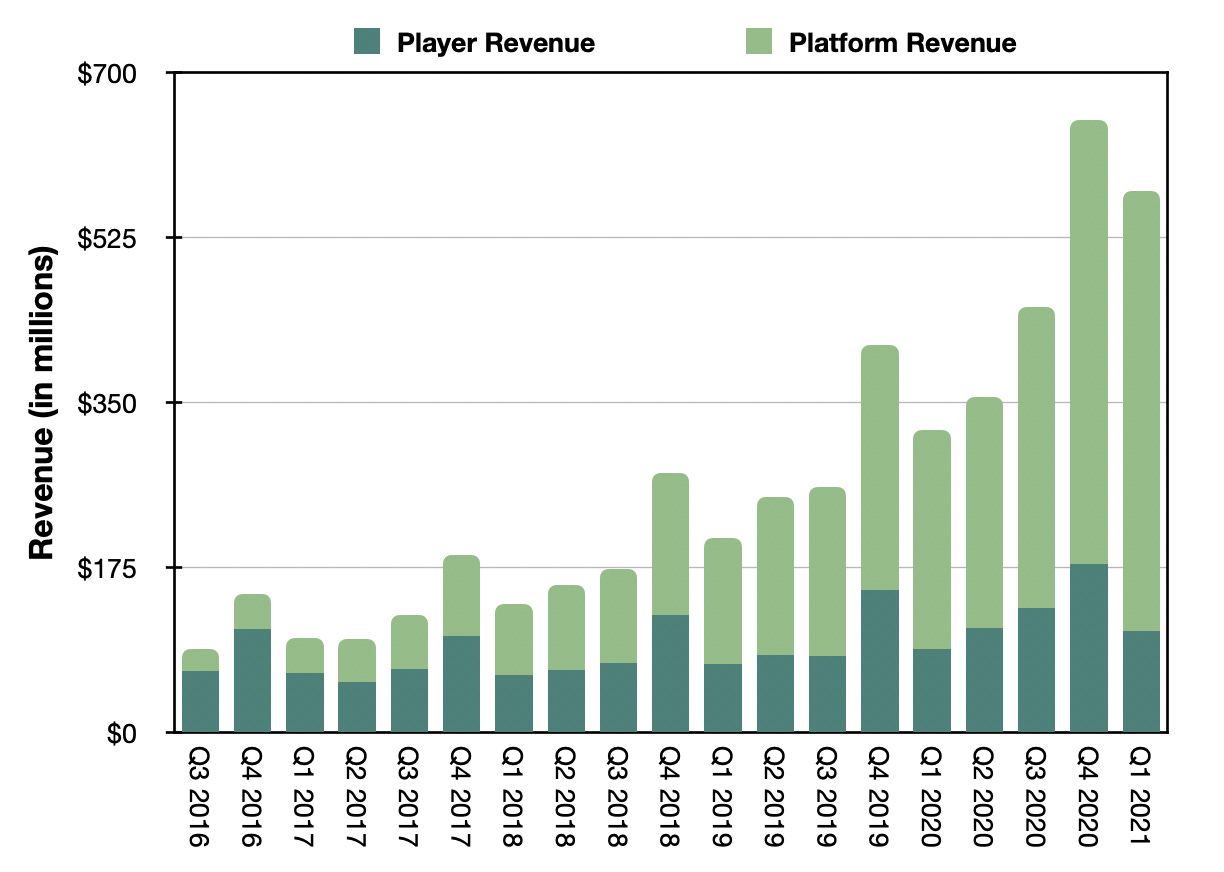

Importantly, Roku Platform’s gross margin percentages are also on the rise, stably growing quarter-over-quarter, as seen below. This is a result of the Roku Platform (which has notoriously carried significantly higher margins than the Roku Player, for reasons mentioned earlier) continuously growing and taking up larger percentages of Roku’s total revenue. Statistics are cool!

Here is a chart I created to outline Roku’s revenue growth since Q3 2016.

As you can see, the Roku Platform has been thoroughly putting the Roku Player on its shoulders, just as Roku had planned in their business strategy.

Now, let’s take a peek at Roku’s operating expenses. Roku bets on themselves, and this is shown in their balance sheets as they are known to incur hefty operating expenses each quarter, as most companies in their “growth” stages often do. In 2020, Roku racked up $828M worth of operating expenses, up 47.8% from the $560M they spent in 2019. Given they spent $251M on operating expenses in Q1 2021, I wouldn’t be surprised if Roku breaches $1B in full year operating expenses for the first time ever in 2021.

As you may be able to tell by their operating expenses, Roku still isn’t profitable. This may come as a surprise given that Roku was founded almost 20 years ago, but this is just how Roku does business. They invest in themselves heavily, which is shown by their impressive growth. But there is some hope — as you may have noticed, Q3 and Q4 of 2020 were Roku’s first and second profitable quarters in the company’s history. Then, Q1 of 2021 followed up nicely with an operational income of $75.8M, Roku’s highest ever. I wouldn’t necessarily rule out another unprofitable year from Roku in 2021, but if I had to place a wager on it, I would bet on this being the company’s first profitable year in history, and hopefully one of many to come from this year going forward.

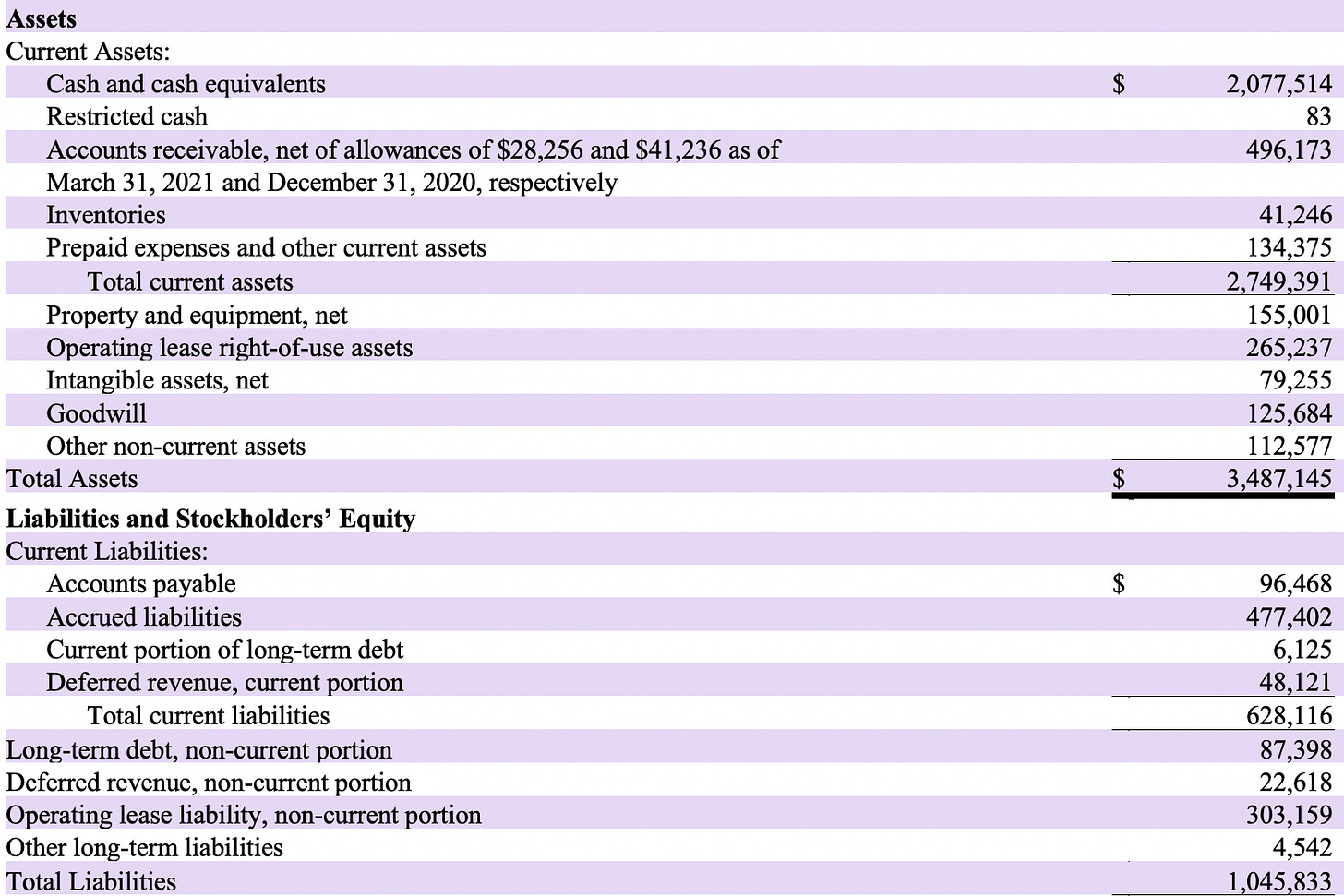

b) Balance Sheet

There’s not a whole lot to talk about, but let’s quickly skim over Roku’s balance sheet. As of Q1 2021, Roku currently has $2.75B in current assets (which is over $1B more than they had in Q4 2020), $3.49B in total assets, $628M in current liabilities, and $1.05B in total liabilities.

Basically, Roku is not strapped for cash, which gives them the availability to make such acquisitions as the ones mentioned earlier in this essay. Above is a screenshot from Roku’s Q1 2021 report, highlighting their assets and liabilities.

c) Useful Operating Metrics

Now for the fun part — let’s take a look at the numbers and statistics that don’t show up on the balance sheets and income statements.

Roku’s active accounts have been rapidly growing for years, with seemingly no end in sight. In 2020, Roku added 14.3M active accounts to bring them to a grand total of 51.2M at year end. Then, in Q1 2021, they added another 2.4M accounts bringing them up to 53.6M, which is where they sit now.

With an increase in active accounts comes an increase in streaming hours, which have grown to impressive heights. In 2020, 58.7B hours were streamed on Roku, a staggering 19.2B hours more than in 2019 (a 48.6% increase year-over-year). With more and more people cutting cords, this figure should continue increasing for years to come.

Lastly, and most importantly, Roku continues to increase their average revenue per user. In fact, Roku’s ARPU has increased each quarter since Q1 2017, proving Roku’s advertising and marketing effectiveness. In Q1 2021, Roku’s ARPU reached a new height of $32.14, making them the industry leader over Amazon’s Fire TV.

Man, those graphs sure are beautiful. It will be a sad day when Roku fails to increase one of the three aforementioned statistics quarter-over-quarter. Roku has put on a display of excellence for the past 17+ quarters, and I don’t see it stopping anytime in the near future.

10. Competition

Roku has no shortage of competition, with many different over-the-top streaming boxes available on the market today, including Apple TV, Amazon Fire TV, and Google Chromecast. Cleary, Roku is up against some stiff competition with three of the largest companies in the world competing in the same industry.

On the bright side, there is plenty of room to run with the TV advertisement industry currently having a total accessible market (TAM) of more than $75B that is set to increase as more and more consumers cut cords and advertisers transfer out of linear TV advertisements and toward CTV advertisements.

Additionally, I think It is important to note that, according to Magna Global, over-the-top advertising accounts for 29% of TV viewing but has only captured 3% of TV advertisement budgets. Think about that for a second — it’s only a matter of time until advertisers shift their focus to OTT/CTV advertisements because if they don’t, they will be left in the dust. Cable is slowly becoming obsolete.

Before we jump into who holds what market share, let’s set the tone by taking a look at the CTV landscape as a whole. According to Leichtman Research Group, the number of U.S. TV-watching households with at least one CTV has grown to 80% in 2020, and half of those users watch at least one video a day.

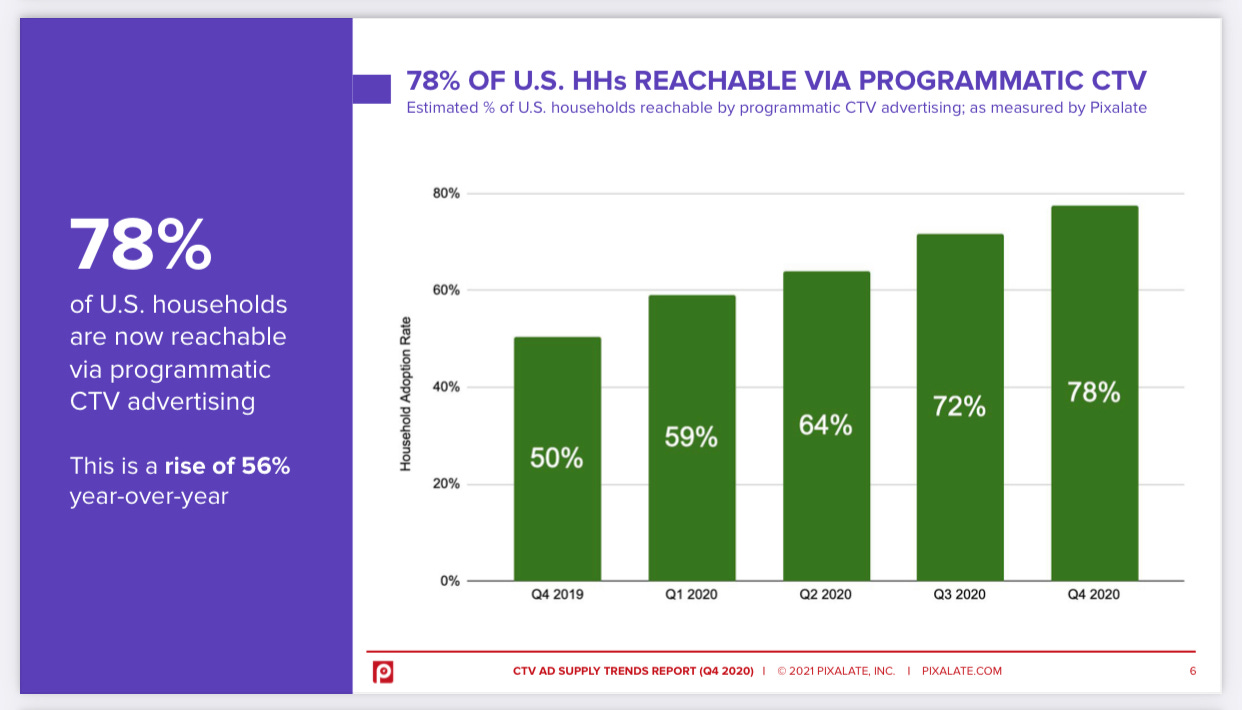

However, according to Pixalate, the number of U.S. households reachable via programmatic CTV advertising (not exactly the same thing) in 2020 is actually 78%, which is a 56% increase year-over-year. Regardless, we can safely assume that roughly 4/5 U.S. households use OTT/CTV and are susceptible to the digital advertisement formats that are considerably more effective than traditional linear TV advertisements.

Importantly, it isn’t just U.S. households that are transitioning to CTV. Global advertisers are spending more money on programmatic advertisements than ever before — a trend that will continue for years to come. The following statistics all come directly from Pixalate:

North America (NA) programmatic advertisement spending increased 123% in 2020.

Europe, the Middle East, and Africa (EMEA) programmatic advertisement spending increased 56% in 2020.

Asia-Pacific (APAC) programmatic advertisement spending increased 106% in 2020.

Latin America (LATAM) programmatic advertisement spending increased 317% in 2020.

And while it may be possible that these numbers are inflated due to Covid-19, the global growth of programmatic advertisement spending has been steadily increasing year-over-year as a result of more households using connected television.

Now that we have shown the growth of CTV across the U.S. and globally over the past year(s), let’s dive into Roku’s market presence. As I mentioned earlier, Roku excels in programmatic CTV advertisements, which is best shown when compared to their competitors.

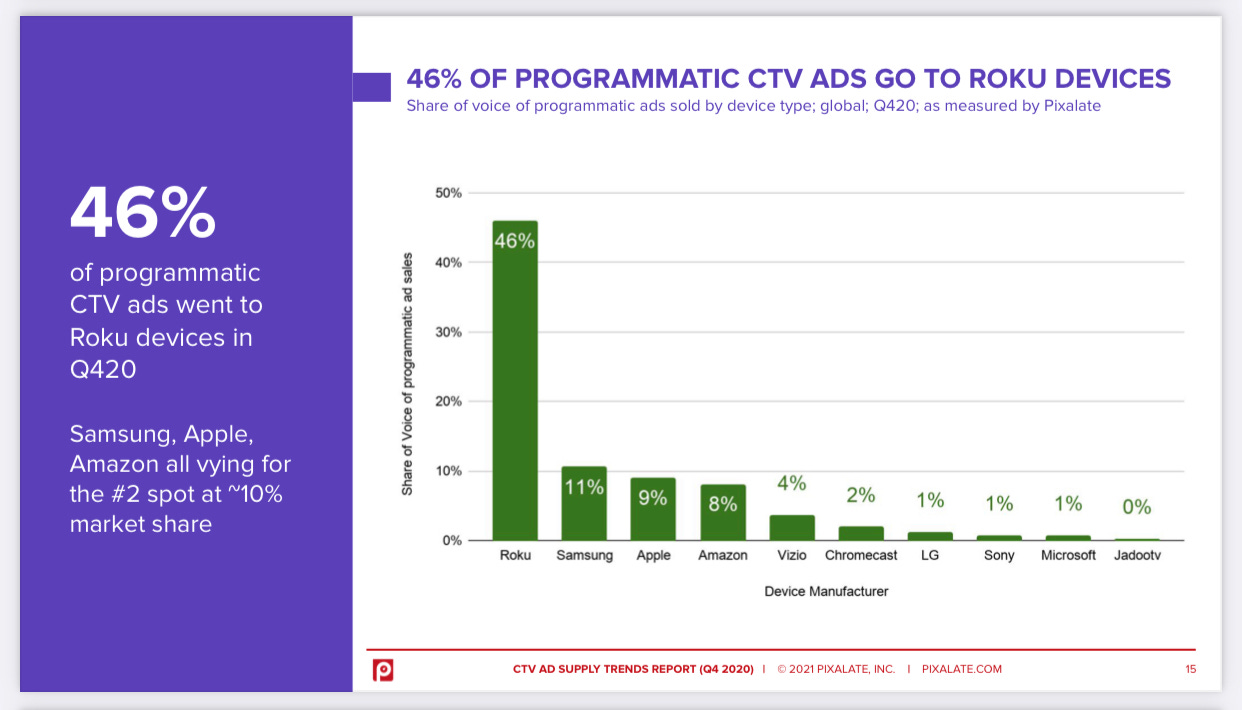

In Q4 2020, 46% of all programmatic CTV advertisements went to Roku devices. Additionally, 46% of programmatic advertisements were sold by Roku’s operating system, Roku OS. Most impressively, both of these statistics are over 4x larger than their nearest competitors… And some people still don’t think Roku has a moat!

That said, Roku may face denser competition in the future as Apple’s market share of CTV advertisements rose a staggering 379% in 2020, though they still only hold a 9% market share in total, as seen above. Interestingly, in 2020 Amazon’s market share of CTV programmatic advertising declined 39%, compared to Roku’s 9% decline.

However, Amazon as a whole (not just their OTT/CTV divisions) still rake in money from advertisements — in May of 2021, CNBC reported that Amazon’s advertisement revenue is now twice as big as Roku, Snapchat, and Twitter combined. So, perhaps Amazon simply isn’t paying as much attention to their OTT streaming content division as other companies competing in the space, though that doesn’t really sound like something Amazon would be comfortable doing. Rather, more than likely Apple’s massive year-over-year growth in programmatic CTV advertisement share combined with Roku’s OneView undisputed excellence have been slowly driving Amazon’s market share down.

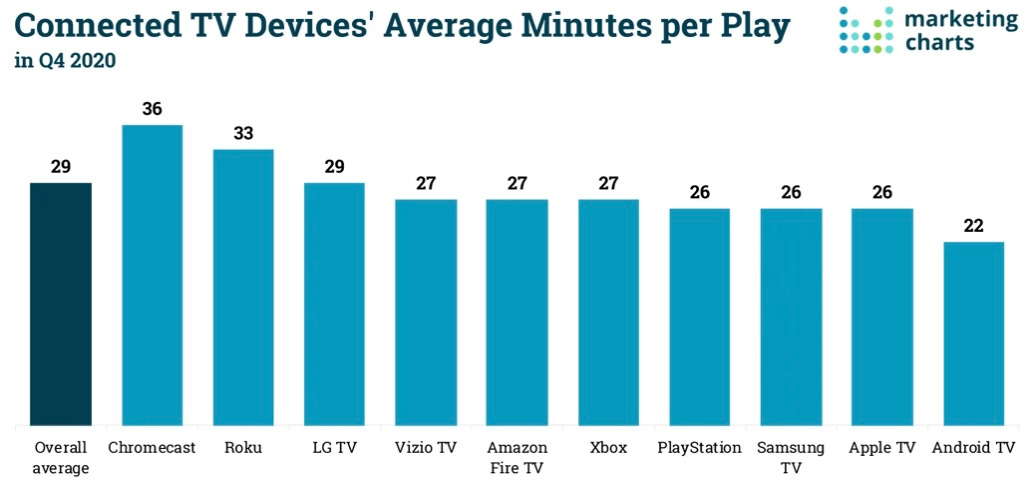

Lastly, let’s take a peek at Roku’s minutes per play compared to their competitors, as of March of 2021.

Roku actually led this category a year ago but has since been slightly trumped by Google’s Chromecast. Nevertheless, Roku holds the largest share of CTV viewing time, controlling nearly 1/3 of the total market share at 31%, so I am not overly fearful of Chromecast’s sudden jump in minutes per play.

And, to conclude the competition segment of this essay, I’ll leave you with this graphic I came across while reading The Trade Desk’s white paper regarding the CTV landscape in 2020. I think it shows that, with a little forward-looking statistics, Roku doesn’t have to be the industry leader to greatly benefit from the cord-cutting expansion that is sweeping the globe… but it sure is exciting given that they are.

11. Critics

To the best of my knowledge, there hasn’t been very many short-seller reports about Roku. I’ve searched for a while and came up with essentially nothing. That being said, I did find a couple Roku references from Andrew Left’s well-known Citron Research, a publication intended to help identify fraud and terminal business models.

On November 28th, 2017, just two months after Roku’s IPO, Citron targeted Roku with this tweet:

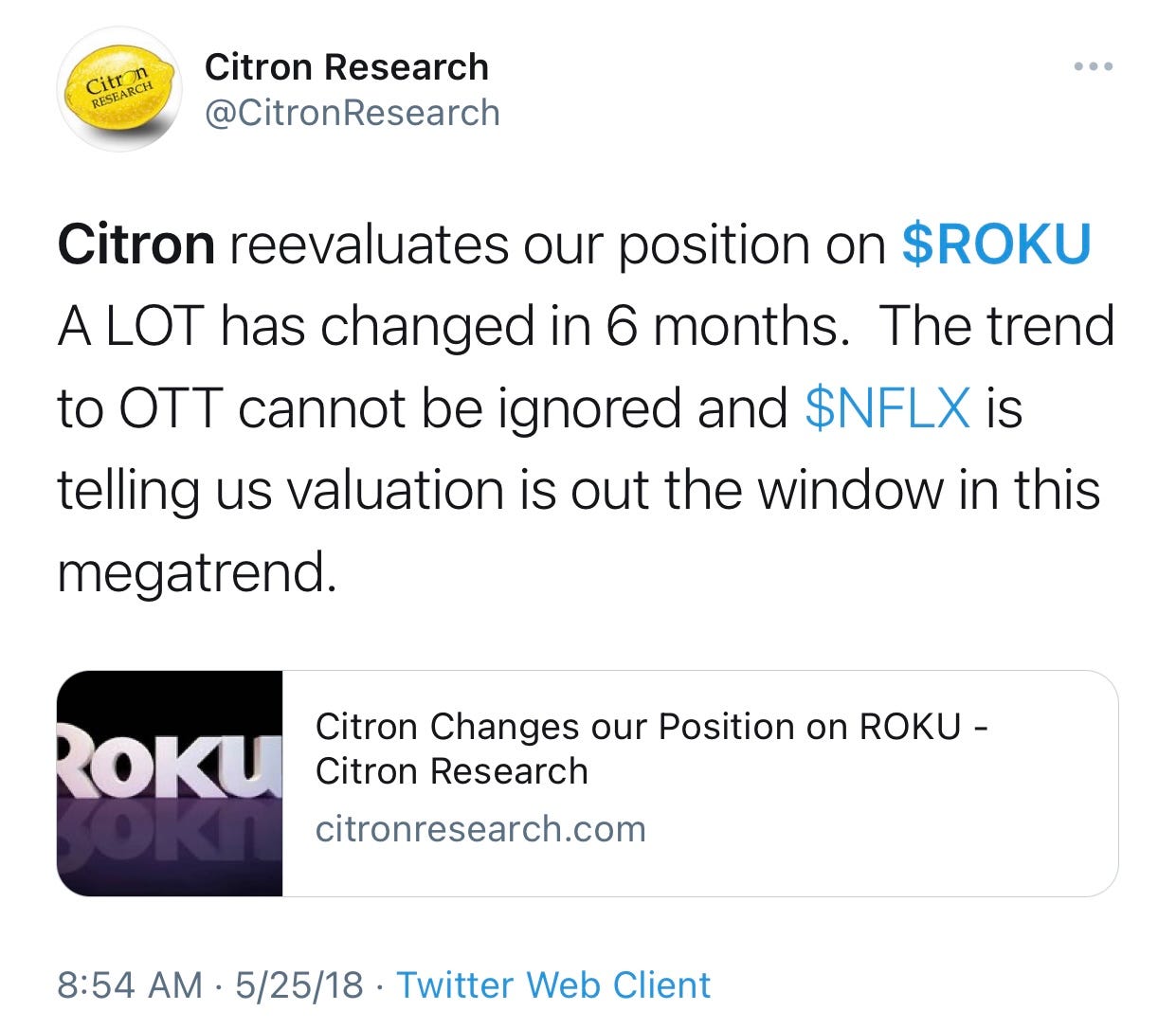

At the time, Roku traded at roughly $45. Their short seemed to work, as Roku did drop back to around $29 before bouncing back in the right direction. Then, on May 25th, 2018, Citron announced that they reversed their position on Roku, declaring it a buy once again, when Roku traded at roughly $38. You can see their announcement tweet here:

In their reversal thesis, Citron stated that “the OTT movement has become a megatrend that cannot be ignored” and that “the numbers around Roku have completely changed” since their short, forcing their hand and causing them to go long.

Again, on January 8th, 2019, Citron targeted Roku once more, saying that they “are watching from the side” with this tweet:

Additionally, Citron followed up the above tweet with a (now deleted) tweet that called Roku “uninvestible.” At the time of the tweets, Roku traded at about $40.

And that just about sums up the short reports that I have found over Roku. I can’t imagine there not being more shorts somewhere, so if you happen to find one or remember one from the past, please feel free to bring it to my attention.

At the time of writing, Roku trades at $323.93 with a P/E ratio of 420.69 (not joking, I couldn’t believe it either). Roku has a short interest percentage of just 2.77% with 3,670,000 shares being shorted of the 132,399,000 shares outstanding.

That said, while unable to find many shorts and despite the low short interest in Roku, that isn’t to say there’s nothing to be fearful of as an investor. There are a few key points of interest that will likely determine whether Roku will transform into a monopolistic advertising conglomerate, or whether they will remain in competition for years to come. The biggest risks, as a Roku investor, are as follows:

International expansion will be a challenge.

Cord-cutting is a global trend, as shown earlier in this essay, but that isn’t to say that Roku will be a significant beneficiary in international markets. Roku will need flawless execution and tremendous a marketing strategy to truly make a run at global dominance, but it’s not like they haven’t done it before.

Roku began laying the groundwork for international expansion in 2019 by expanding its marketing and offering in Mexico, Canada, and select parts of Europe and Latin America.

For now, Roku appears to be tackling international markets on the back of their Roku TVs as opposed to their traditional digital media players. In the past year, Roku has started rolling out Hisense RokuTVs in the United Kingdom and AOC RokuTVs in Brazil.

Here is an excerpt from Roku’s Q4 2020 ER that states their position on global expansion:

2020 was an outlier year due to Covid-19.

It was. No doubt about it. In 2020, Roku experienced more growth than ever before across just about every measurable category, and this is surely thanks in part to everyone being forced to stay at home day after day. But that wasn’t Roku’s only catalyst for 2020 by a long shot — Roku made several crucial acquisitions in the past year, formed many significant partnerships, pushed out OneView at unprecedented levels, and began enterprising in global markets like never before.

I would encourage everyone to take a look at some of the bar graphs I have displayed throughout this essay and apply an imaginary trendline and decide for themselves just how much of an outlier 2020 was. I think you will be pleasantly surprised.

Competition is strong and Roku doesn’t have a moat.

Without question, this is the most common argument I see against Roku. In a way, it’s true — competition is strong. But because competition is so stiff, it doesn’t allow Roku to turn on cruise control; Roku must always have the pedal to the floorboard, innovating, disrupting, making acquisitions and partnerships, and taking asymmetric risks without hesitation. In fact, one could make an argument that Roku wouldn’t be the powerhouse they are today without such stiff competition.

As for Roku not having a moat… that is just simply not true. If that isn’t clear by now, I’m not sure what else Roku needs to do — OneView reaches 4/5 homes in America and Roku controls 46% of the CTV programmatic advertisement market share. That is one hell of a moat if you ask me. Why would any advertiser use a different DSP?

12. Points of Emphasis

Alright. We covered a whole bunch in this essay and there is a lot to digest. Allow me to wrap it all up with a couple critical points that need to be driven home:

According to eMarketer, in 2020, Roku users make up roughly 1/3 of U.S. internet users.

Last updated, Amazon announced in December of 2020 that the Fire TV user base has exceeded 50M — this means that in terms of users, Amazon is neck-and-neck with Roku. That said, it has been reported that Amazon’s Prime Video watchers (which is not quite the same thing as a Fire TV user) is nearly 170M, which is a staggering number to say the least. Despite this mind-boggling statistic, Roku still controls 46% of CTV programmatic advertisements, which is pretty incredible and far more “important” for lack of a better word.

Roku is the industry leader in average revenue per user (ARPU), and while competitors’ numbers are not clearly defined anywhere, Roku claims they are the leader “by a large margin” at $32.14 as of Q1 2021.

The DSP from the dataxu acquisition, which Roku rebranded as OneView, gives Roku access to any advertisement inventory that dataxu previously had access to — this includes other OTT platforms such as Hulu or Netflix, in addition to linear TV advertisements and other forms of digital media through various sell-side platforms.

OneView is a DSP that is a culmination of Roku’s industry-leading first-party data and their acquisitions, namely dataxu’s attribution tools and Nielsen’s automatic content recognition (ACR) and dynamic advertisement insertion (DAI) technology. Because of the vastness of the OneView Advertisement Platform — that is, the ability to sell advertisement inventory across OTT TV, CTV, linear TV, desktop, and mobile — Roku estimates that their DSP system reaches an incredible 4/5 homes in America.

The Roku Channel is growing rapidly, which gives Roku tremendous leverage in partnership negotiations, which leads to higher quality content on The Roku Channel in exchange for less cash and slightly less advertisement inventory on that particular publisher’s app.

All aspects of Roku’s business are growing at tremendous rates; year-over-year, total revenue is up 79%, gross profit increased 132%, total gross margin percentage added 1290bps, streaming hours increased by 48%, active accounts are up 38%, and ARPU showed continued improvement, up 24%.

After nearly 20 years of business, 2021 is estimated to be Roku’s first ever profitable year.

Okay, maybe that was more than just a couple critical points. If you skipped to the end to just read this segment, you pretty much got the gist of the essay, but I think it’s especially important to read it in its entirety to get the bigger picture. Regardless, I think it’s clear that there is a lot to be excited about regarding Roku and the digital media landscape as a whole.

Since I couldn’t help myself and essentially made my critical points an entire TLDR, I think it’s fitting for me to sum up the common misconception about Roku in one paragraph:

Roku isn’t a bet on them as a streaming service, it’s a bet on the streaming industry as a whole. With the cord-cutting trend growing faster than ever before, Roku’s industry leading user base, streaming hours, and average revenue per user combined with their unprecedented control over the CTV programmatic advertisement landscape puts Roku in a position of dominance for the foreseeable future. Their hardware is the fisherman, their streaming service is a fish in the water, and their software/advertising is the entire ocean. If streaming beats cable, then Roku beats the bears.

And there you have it. Before I go, I’d like to give a special thanks to Innovestor, Mark, Parrot, and Caleb for proof-reading this essay and providing valuable feedback. I extended my deepest gratitude to you guys for taking time out of your day to help me draft this essay. Be sure to check them out on Twitter!

If you enjoyed this look into Roku’s background and opportunity, please feel free to share — it would really help me out. My DMs on Twitter are always open, and I would love to hear feedback to learn and improve.

Thanks for reading! I am wishing all of you nothing but the best.

— Nick

An outstanding report on ROKU. Really nice work, excellently presented.

Roku runs fraud business. Their The Roku Channel business is exaggerated and misguided by their so called leadership. Someone should ask this to their VP Mr. Rob Holmes on why they are faking these numbers. Roku has only 4-5M active accounts that watch The Roku Channel. Rest of the numbers are exaggerated and faked by Roku to keep their investors happy.

Someone ask Rob Holmes at Roku about true streaming hrs on the Roku channel and how many unique users are watching it.