Fiverr: A Revolutionary Digital Marketplace

Disproving in-person theories, disrupting the common workplace, and empowering the creator economy... all at once.

In this issue, we will be covering Fiverr’s:

Background

Management

Operations

Fiverr Marketplace

Fiverr Business

Potential

Competition

Financials

Critics

Points of Emphasis

Let’s jump into it.

1. Background

In as few words as possible, Fiverr is an online marketplace connecting buyers to freelancers.

There are more freelance services (known as “gigs” throughout the Fiverr ecosystem) available than you can possibly imagine, with an ever-increasing variety of gigs being added to the platform each day. Gigs may range from graphic design specialists to personal website reviewers to “professional” Fortnite coaches… seriously.

That said, to post a gig on Fiverr, your service must fall under one of Fiverr’s nine verticals, each of which have different categories and subcategories within them. Currently, Fiverr’s nine verticals are:

Graphics & Design

Digital Marketing

Writing & Translation

Video & Animation

Music & Audio

Programming & Technology

Data

Business

Lifestyle

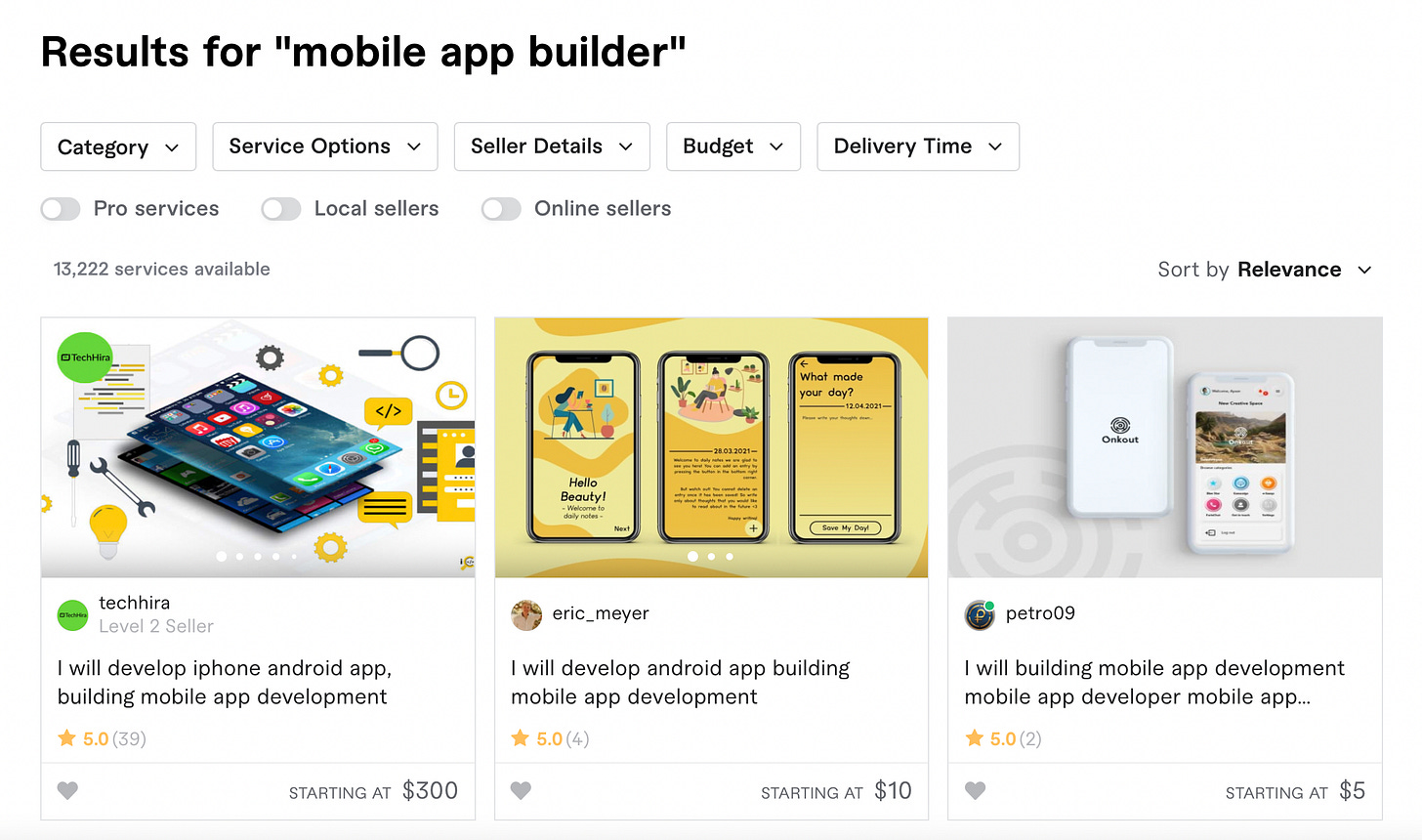

Those in need of freelance services may go to Fiverr’s website, search keywords for the job they need completed, and will instantly be shown a catalog of freelancers complete with filters available to narrow down search results.

Additionally, from the main search catalog, buyers are able to see a freelancer’s:

Username and profile picture

Description of provided services (in the freelancer’s own words)

Rating (on a scale of 5.0)

Examples of work

Starting price

From there, buyers may “shop around” by visiting various freelancers until they find one that best suits their needs — as a user, it has an uncanny resemblance to shopping on a traditional eCommerce store, such as Amazon.

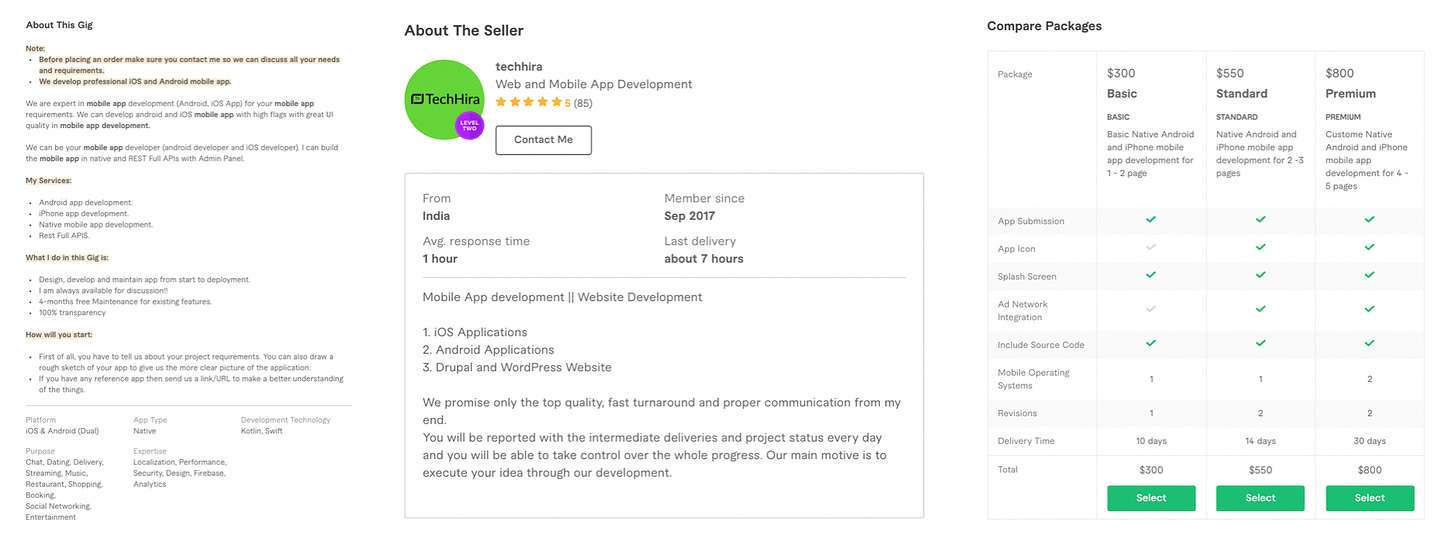

Upon clicking a service, the customer is presented with:

More examples of previous work by the chosen freelancer (a.k.a. the seller).

An in-depth overview of the exact services provided by the seller.

An “About The Seller” section that shows where the freelancer is from, how long they have been on the platform, their average response time, and when their last delivery was.

A “Compare Packages” section where the customer can view different packages offered by the seller, complete with a comparison chart.

Similar recommendations in case the freelancer doesn’t offer quite what the buyer is looking for.

A “Reviews” section that is exactly like one you would find on Amazon, eBay, Etsy, and other online marketplaces.

Furthermore, buyers are able to “favorite” specific freelancers which adds them to a customizable list for future viewing/ordering.

Sound like an eCommerce website yet?

2. Management

Fiverr was founded in February of 2010 by Micha Kaufman and Shai Wininger, who visualized a two-sided platform for buyers and sellers to connect regarding services typically offered by traditional freelancers. Fast-forward just two short years and Fiverr already hosts over 1.3M gigs via their platform. By the next year, Fiverr was ranked as one of the top hundred most popular websites in the United States, and one of the top two hundred most popular sites worldwide — an achievement they still hold today.

Micha Kaufman has served as Co-Founder, CEO, and Director of Fiverr since the company’s inception in 2010. Prior to developing, founding, and running Fiverr, Kaufman founded (or co-founded) and led several other technology companies, including:

Keynesis — a security software and encryption company designed for tablets, portable devices, and cloud computing.

Invisia — a business process service provider operating in customer care, mortgage, title insurance, flood insurance, and tax.

Spotback — a personalized news site that learned from clicks and ratings to automatically prioritize news sources, articles, and other entities over time.

Accelerate — an accelerator program for young, passionate entrepreneurs.

Micha has previously stated that he often hired freelancers in the development stages of his companies, but they were always “high friction” processes — this served as inspiration for Fiverr’s inception.

As time went on, I thought to myself that there had to be an easier, more seamless way of going about this.

Micha continues to be a vocal leader and prominent role model in the ever-expanding Israeli entrepreneurial community.

Shai Wininger, Fiverr’s Co-Founder, does not currently have a role within Fiverr. Instead, Wininger serves as the Co-Founder, President, and COO of Lemonade, Inc (NYSE: $LMND), the “world’s first peer-to-peer” insurance company powered by artificial intelligence and behavioral economics.

Shai was previously the CTO and a Board Member at Fiverr before focusing his attention to Lemonade, and previously worked with Micha Kaufman at Keynesis and Accelerate.

Ofer Katz serves as Fiverr’s President since February of 2021, and officially as CFO since July of 2017, though he had been a consultant CFO since 2011. Previously, Katz founded Nextage, a financial services firm, where he served as CEO from 2001 to 2016 and currently serves as Co-CEO. While CEO of Nextage, Katz served as acting CFO for a number of companies, including Wix.com (NYSE: $WIX).

3. Operations

Before we begin, I feel it’s important to note that Fiverr refers to themselves as a technology company at their core, not just a company that uses technology — there is an important distinction between the two.

Now, let’s dive into it.

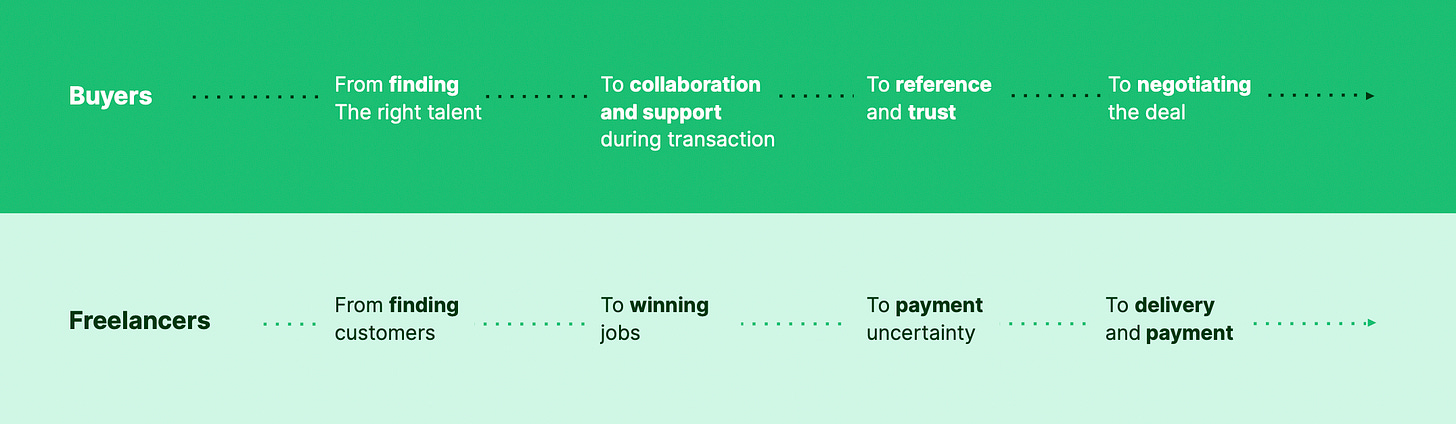

Fiverr is a two-sided marketplace (meaning there are buyers and sellers, each of whom may join and purchase/provide a product or service at their own disposal, similar to eBay) that uses a Service-as-a-Product (SaaP) business model. Notably, Fiverr’s SaaP business model makes buying and selling freelancing services a seamless transaction comparable to shopping on Amazon.

This effectively removes the high friction process that comes with traditional freelancing, as depicted in the graphic below.

I bet Micha Kaufman wishes a service like Fiverr was available in his younger years when he was building all his various companies. Actually, on second thought, maybe not.

Additionally, Fiverr’s two-sided end-to-end platform provides a unique high-trust transaction between the buyer and seller. High-trust transactions are extremely important in eCommerce stores and even more-so in the freelancing industry. If you’re unfamiliar with high-trust and low-trust transactions, let me quickly break it down for you:

High-trust transactions are backed by relationships and product quality. By working closely with a freelancer, you are able to be alongside your product or service through every step of the process, effectively leaving you with your desired purchase — this means there’s a happy buyer and a satisfied seller. By doing so, you form high-trust relationships, which leads buyers back to the same seller time and time again. Shopify prides themselves on being a high-trust company; in fact, Shopify takes their high-trust ecosystem so seriously that they refer to themselves as a “relationship company” powered by a trust battery and not just another run-of-the-mill eCommerce store.

Low-trust transactions are easier to explain — they occur when you want (or need) a product as soon as possible. In low-trust transactions, quality is often pushed aside and relationships are completely out of the picture. A good example of this would be buying an off-brand pair of headphones at a gas station or convenience store. Obviously the buyer isn’t expecting studio quality, rather he/she just wants something that will suffice. In a couple weeks the headphones will break or be lost, and the buyer will never again return to buy that same pair of headphones because:

the quality is poor

the buyer has no relationship with the seller

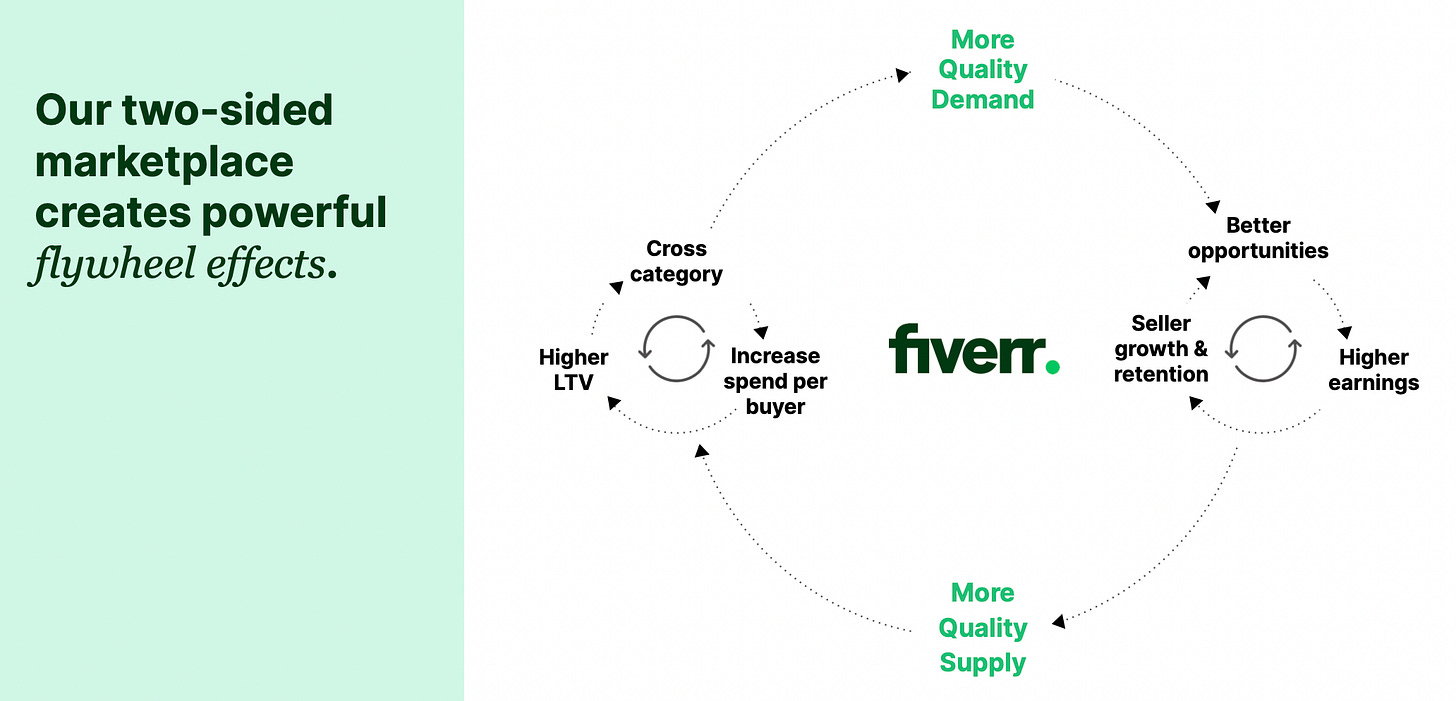

These high-trust transactions provide immeasurable value to the Fiverr ecosystem that create the “powerful flywheel effects” that are seen in the graphic below.

Now that the preliminary work is out of the way, let’s learn how Fiverr actually runs its business.

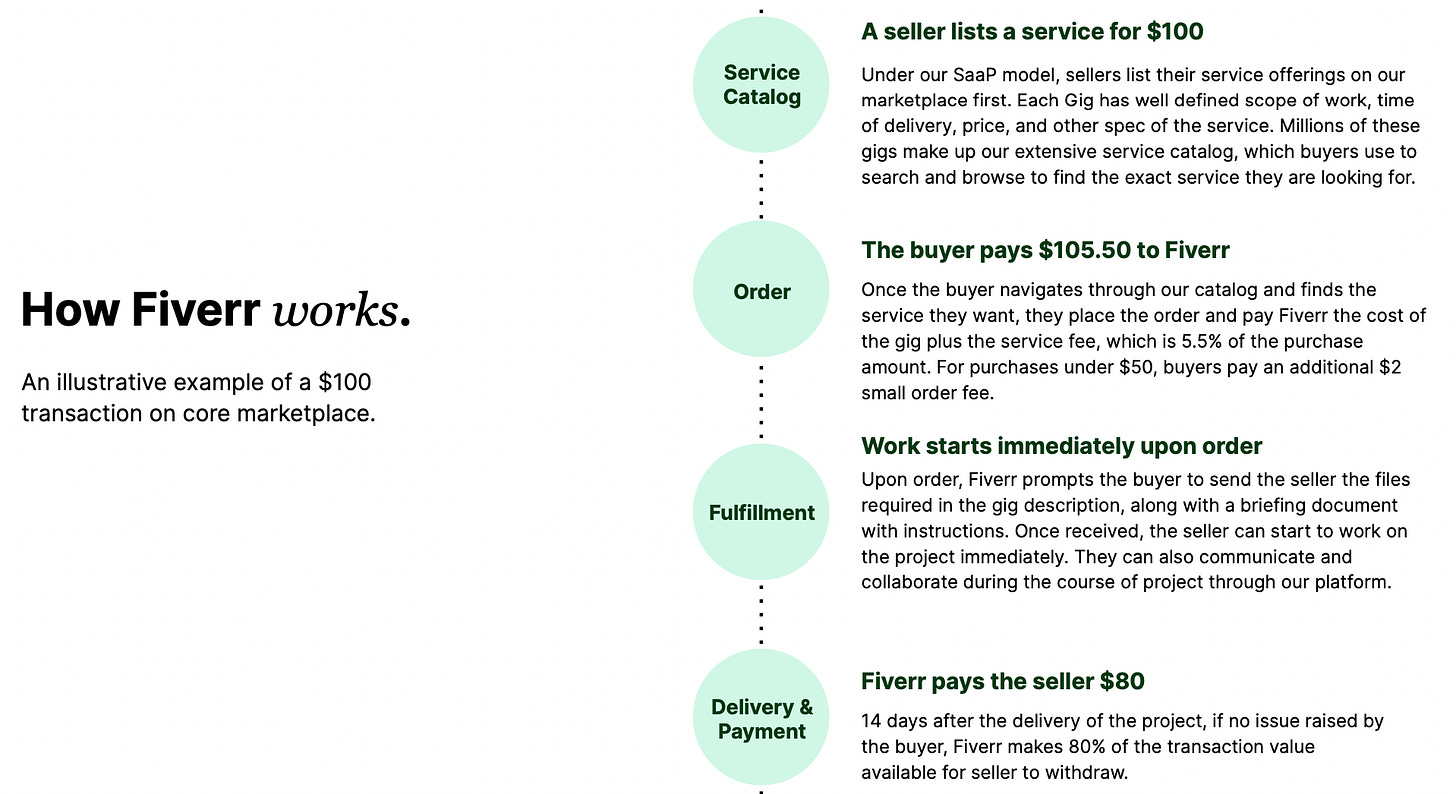

Fiverr takes a cut from each and every transaction made on their platform — they take 5.5% from the buyer and 20% from the seller. That’s pretty much it. Fiverr does a wonderful job of visualizing this process in their company presentation, which is where I have been obtaining most of the graphics used in this section of the essay.

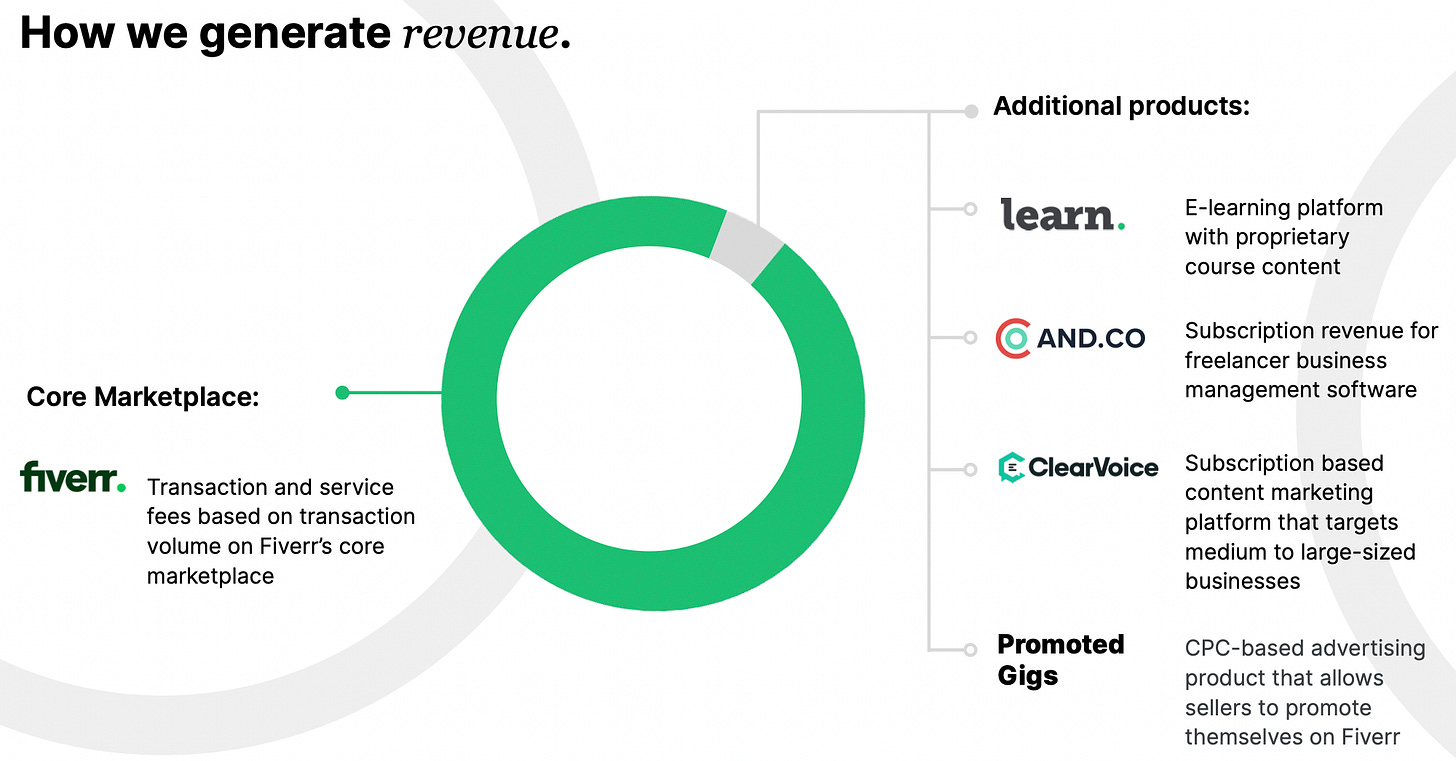

While this isn’t Fiverr’s only source of revenue, it does account for a large percentage of it (the actual number is not provided, but you will get a decent visual at the bottom of this paragraph). The remaining percentage of Fiverr’s revenue is comprised of additional products offered by Fiverr, which includes:

Fiverr Learn — an e-Learning program that aids freelancers via instructional courses, allowing them to continuously improve their skills and services.

AND.CO — a Fiverr acquisition that handles back-office management for freelancers, from proposals to payments.

ClearVoice — a Fiverr acquisition that provides a premium subscription-based content marketing platform for freelancers.

Working Not Working — a Fiverr acquisition that is a leading platform for high-end creative content, trusted by Netflix, Google, Spotify, and others.

Promoted Gigs — a cost-per-click (CPC) advertising service that allows sellers to actively promote themselves on Fiverr’s marketplace.

Given that Fiverr’s additional products are relatively summed up in their entirety in the above graphic, I’ll expand on Fiverr’s operations by splitting their core marketplace into two divisions:

Fiverr Marketplace (which includes Fiverr Pro)

Fiverr Business

Interested in learning more? Of course you are. Let’s get to it.

4. Fiverr Marketplace

Fiverr Marketplace is the heart and soul of the platform and business model, but to be frank, there isn’t much to talk about here that we haven’t already covered, outside the addition of Fiverr Pro — we will get to that momentarily.

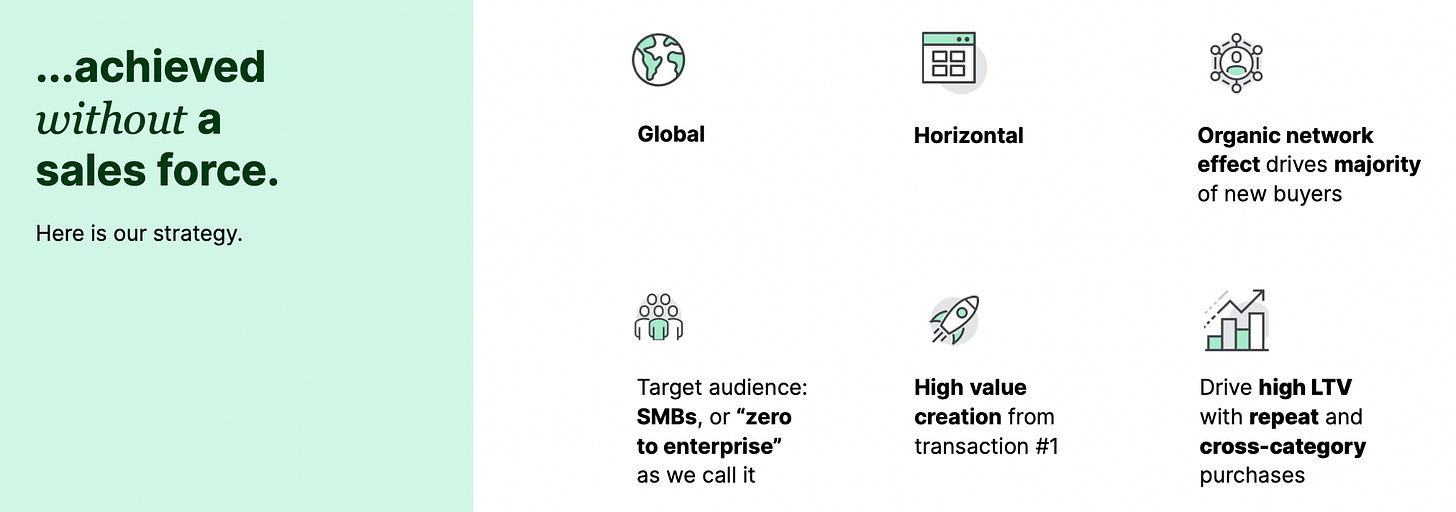

Fiverr Marketplace is exactly what it sounds like; the marketplace where freelancers may publish their gigs and where buyers may explore options and purchase services. The marketplace is horizontally integrated, counting on organic networking effects via high-trust transactions to propel platform growth, leading to repeat buyers and valuable long-term sellers.

The Fiverr Marketplace is complete with freelancers of all variety, both old and new. To help buyers get a better sense of who their money is going to, Fiverr has a implemented a review integration, similar to that of Uber or DoorDash — if a seller has too poor of a rating they will no longer be able to use Fiverr’s platform to sell their services. All ratings are based on a 5.0 scale, and sellers are strongly encouraged to put their best foot forward thanks to:

repercussions for sellers with bad ratings (i.e., getting booted from the platform)

extra benefits for sellers with a strong history of exemplary work

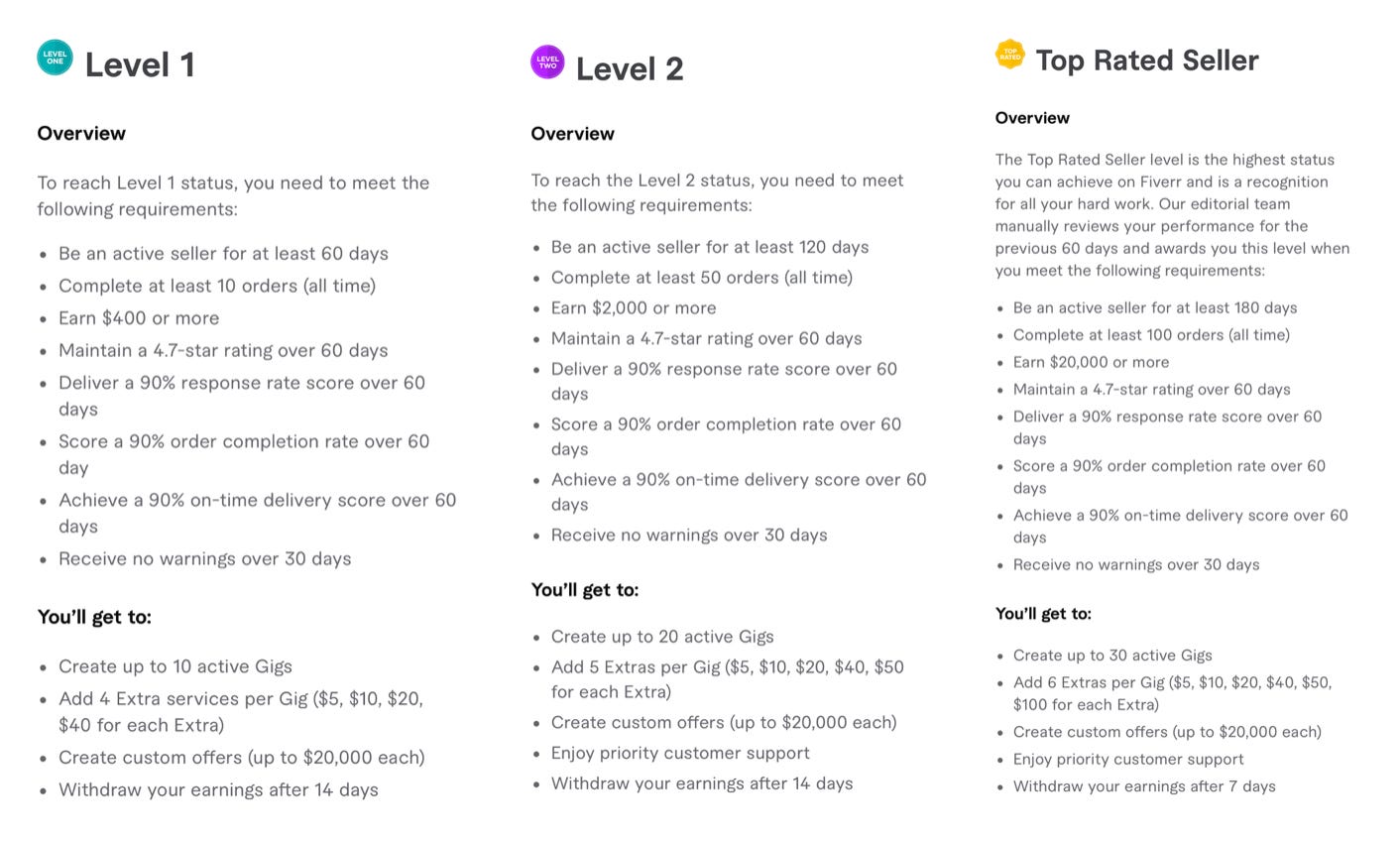

The extra benefits are granted based on what “level” the seller has achieved on a three-level basis, denoted as:

Level 1 Sellers

Level 2 Sellers

Top Rated Sellers

Here are the requirements that must be met in order to achieve such a status and move up the prestigious seller chain.

In addition to ratings and levels, sellers that go above and beyond expectations may be selected as a Pro Verified Seller — sellers hand-picked by Fiverr for continuously exceeding all necessary requirements and leading to superior buyer satisfaction.

Being a Pro Verified Seller is the highest honor on the Fiverr platform, as only 1% of applicants earn Pro status. To become a Pro, applicants must pass through a rigorous application process, complete with a background check, professional experience, and on-going excellence.

That said, buyers who use Pro Verified Sellers can rest assured, knowing that their purchase is in the hands of a certified professional who constantly overdelivers and has been trusted by some of the top brands in the world.

The constant uphill battle with keeping the Fiverr Marketplace both regulated and simultaneously open to everyone is being aggressively tackled with the implementation of all the aforementioned quality assurance checks (the reviews, levels, and professional verifications). At the end of the day, if a particular freelancer’s service appears to be significantly cheaper than competitors, the buyer should expect a lower quality work. Plain and simple. In my eyes, this isn’t a Fiverr problem; it’s the buyer’s problem.

All eCommerce websites have cheaper, knock-off versions of quality products. Go look at Amazon’s website — you’ll find tens or even hundreds of similar products at vastly different prices. It’s the buyer’s responsibility to do the research, read the reviews, and come to a sound conclusion on whether he/she trusts the seller/product to be of good value and satisfactory quality.

If a buyer gets ripped off by a Top Rated Seller or a Pro Verified Seller, that’s one thing. But that doesn’t happen. The poor-quality services don’t come from these people; they come from the freelancers with no reviews that are charging pennies on the dollar compared to any trustworthy competitor.

How’s that age-old saying go? You get what you pay for? Something like that.

5. Fiverr Business

Fiverr Business was introduced in September of 2020, amidst the Covid-19 global pandemic, in an effort to unite businesses and provide a collaborative platform for teams.

Fiverr Business is all about collaboration. Our business tool allows you to organize and manage all your projects, communication, deliveries, and budgeting in one dashboard. You can share a payment method with team members, save and share favorite sellers for quick access, and contact a dedicated Fiverr Business Success Manager to help you find the right sellers.

Fiverr Business costs $149 annually, but Fiverr gifts you an entire year for free upon signup to fall in love with the platform and all the unique features included in the package. These features include but are not limited to the following:

Personal business success manager

Curated catalog of the finest freelancers on the platform

Tools to make collaboration easy and seamless

Customized management and budget flow

Payment methods suitable for businesses

Up to 50 active team members (with extensions available to add more, if needed)

While being a relatively new integration to the Fiverr ecosystem, Fiverr Business is already trusted by some of the top brands worldwide, including makeup conglomerate L'Oréal and the British multinational consumer goods enterprise Unilever (NYSE: $UL).

Fiverr aims to keep expanding, marketing, and building Fiverr Business for years to come, with remote work becoming more and more feasible with each passing day.

6. Potential

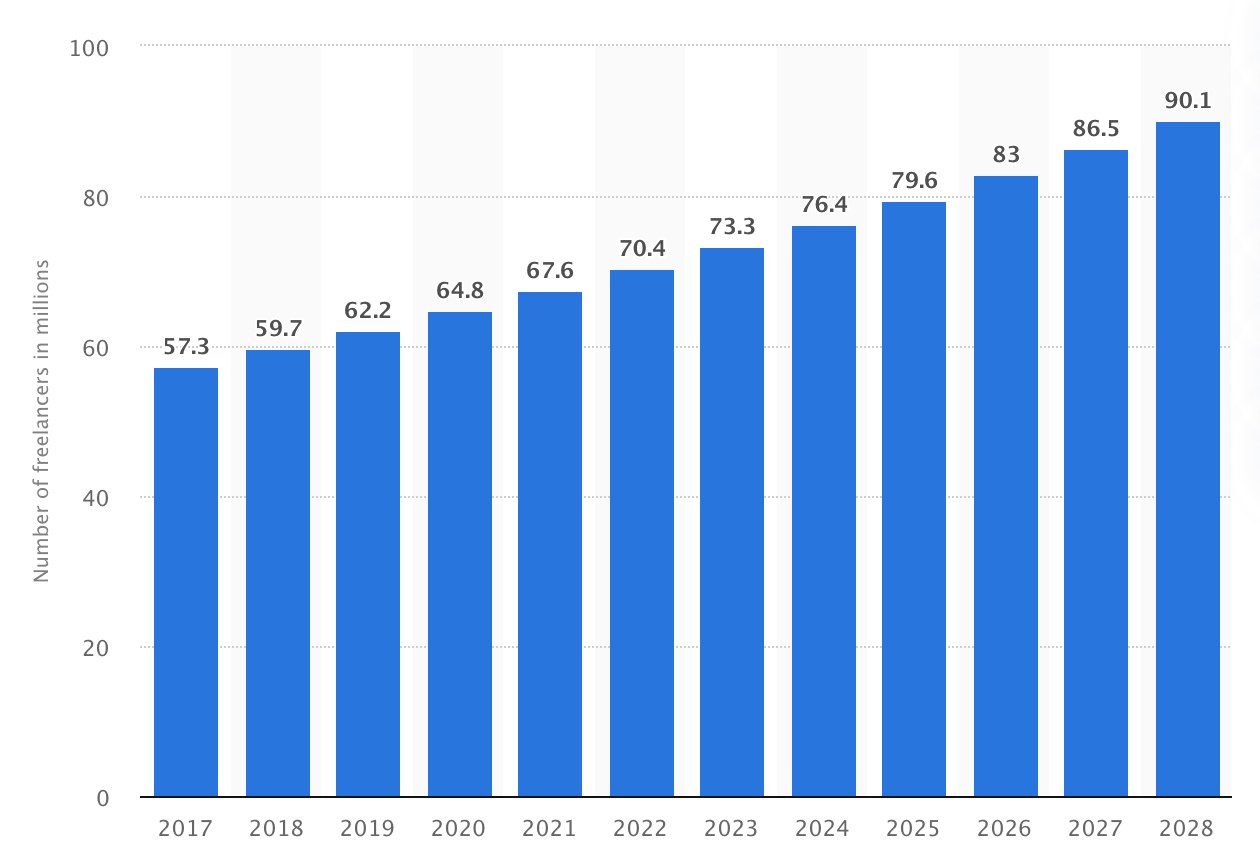

There is much to say and even more to speculate about the state of the freelancing in today’s workforce. The general consensus is that we are still very early in the game, with roughly just 36% of the United States labor force participating in freelancing activities, whether that be part-time or full-time. That being said, Statista projects that the number of freelancers in the United States will reach 86.5M by 2027, which would equate to roughly 50% of total United States workforce.

Regardless of how fast you expect the freelancing industry to grow, one thing is for certain — Covid-19 has shown us that remote work is absolutely possible (and effective) in far more industries than initially imagined.

Usually, I would include all the following statistics under “The Numbers” section of this essay, but I ran across Upwork’s 2020 White Paper (a direct competitor of Fiverr) which did a phenomenal job of outlining the state of the industry and future progression through a flood of impressive statistics and there is simply too much information to touch on that I feel it would overwhelm Fiverr’s financials if I included it under that section, which is why I am adding it in here. That sentence was incredibly long. I hope it made sense.

Anyway, without further ado, let’s dive into it.

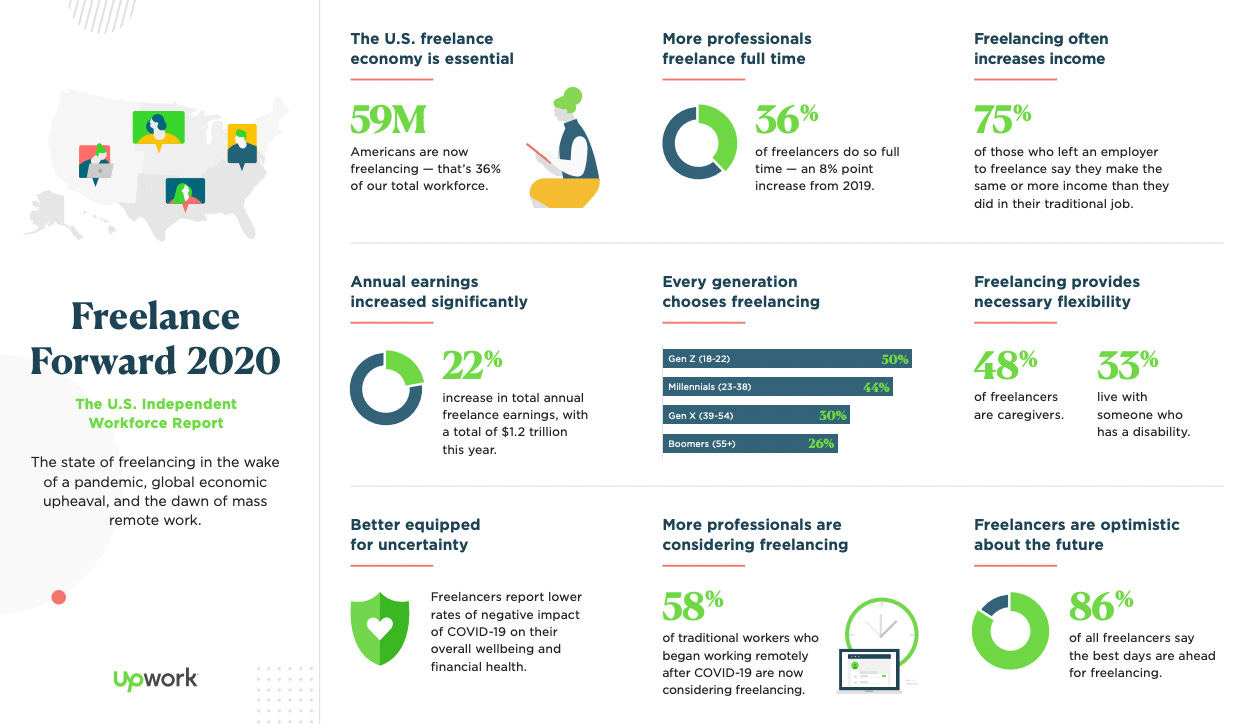

There’s truly not much for me to say about the following graphic that it doesn’t say by itself, so I’m not going to beat around the bush here: 2020 was an undeniable catalyst in remote work and, importantly, there are no signs of it slowing — the flexibility of remote work may very well be the new normal.

Those are some powerful figures, and it makes it easy for me to see why freelancing is not an option but borderline necessary for certain individuals. Truthfully, I didn’t consider freelancers simply being unable to work an in-person job because they are deprived the flexibility needed to constantly care for other individuals who depend on their help, like those with disabilities. This was an eye-opening realization for me that I shamefully hadn’t considered before drafting this essay.

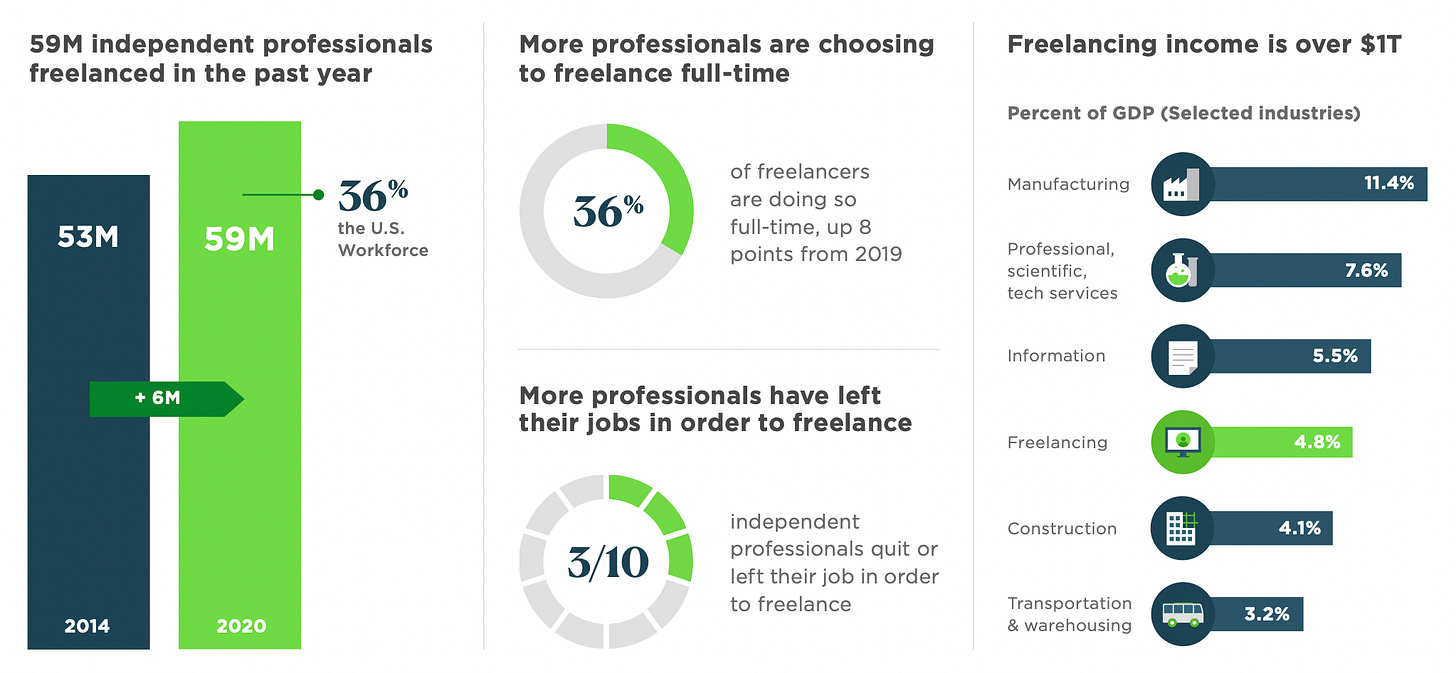

Additionally, I think it’s important to note the 8% uptick from 2019 in the number of full-time freelancers and that 75% of freelancers make more income from freelancing than they did at their previous employer. Together, these prove the legitimacy and effectiveness of freelancing when doing it as a primary source of income, which I feel more and more professionals will begin to take note of and begin their transition into freelancing. This is a trend that is already starting — 3/10 professionals left their job in 2020 and began freelancing.

Are you surprised at how established freelancing already is in the United States? I know I was — I would have never guessed freelancing to make up 4.8% of the U.S. GDP and I certainly wouldn’t have assumed it to be a larger industry than construction or transportation/warehousing.

Fiverr’s additional revenue streams (specifically, their e-Learning center, business management software, and content marketing platform) should continue to benefit considerably from the transition to remote work and online conferencing, as proven by the graphic below.

If 5x more content is actually absorbed through e-Learning, it makes me question why we haven’t completely transitioned to this format a long time ago.

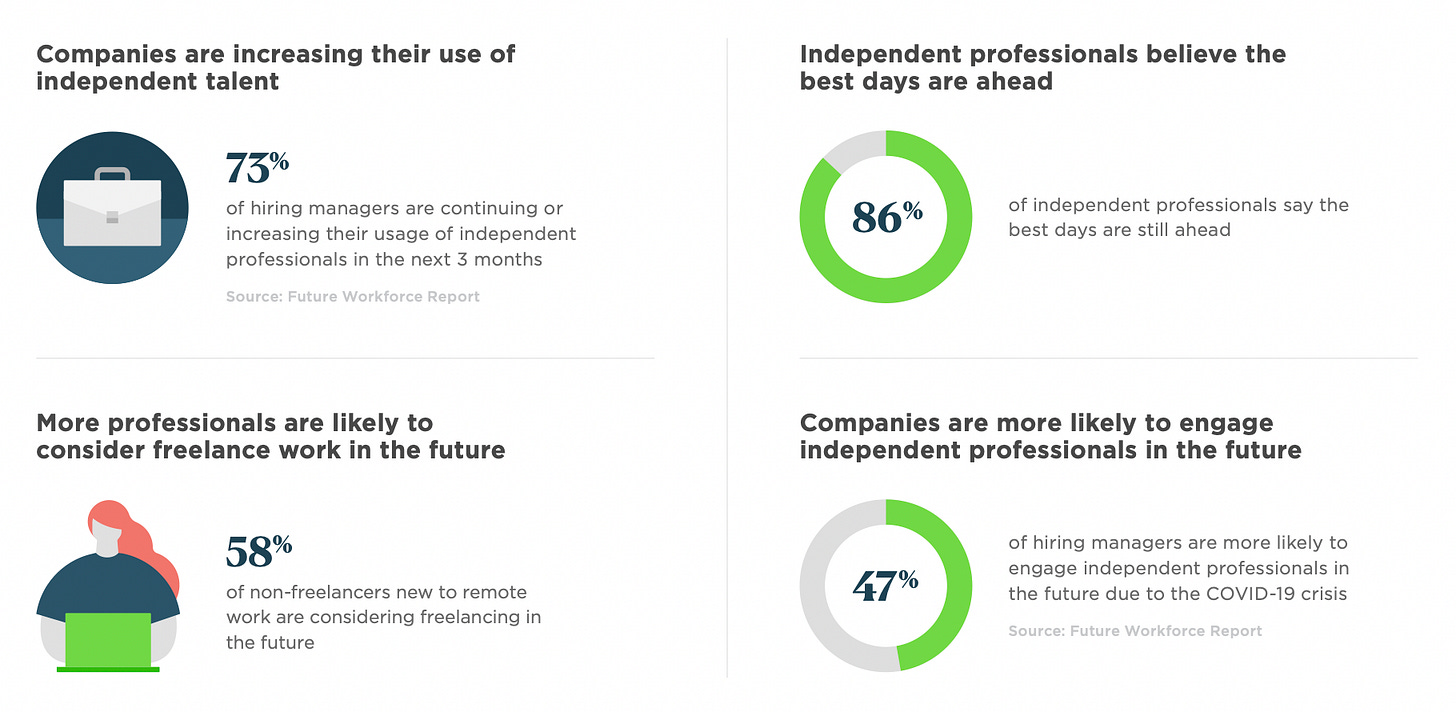

Lastly, I’ll conclude this segment of the essay by providing one last graphic that shows the direction of freelancing as a whole.

Nearly one half of hiring managers are more likely to hire independent, professional freelancers than a traditional trained professional. To me, this says that the workforce is becoming more job-oriented rather that company-oriented. Company pride may be a dying breed in the future, and it’s not being brought on by the workers, but by companies themselves.

Freelancers remain fresh by always working on new, exciting products from anywhere with an Internet connection and earn more income than ever before, while hiring companies get a highly focused, job-specific professional with a proven track record of exceptional work — that sounds like a win-win to me.

7. Competition

I’m sure this is the part of the essay that many readers are most curious about, and rightly so. Fiverr operates in an extremely competitive landscape with very few barriers to entry. The freelancing digital marketplace is pretty well dominated by two players (Fiverr and Upwork), with other intermediary players mixed in, such as Toptal or Freelancer.

Since Fiverr and Upwork are the two of the largest operators in the industry and are the only two publicly traded companies on the list, the main focus of this segment will be comparing the two — this isn’t to say the others should be ignored, though. On this note, I think it’s important to mention that the freelancing industry is not a winner-take-all situation, and there is plenty of room for multiple companies to experience major growth in the future — especially with the projections for the industry going forward. After all, hypothetically speaking, the total addressable market is the entire global workforce.

Now that we got that out of the way, let’s see just what Fiverr is up against.

There are some defining characteristics that separate Fiverr’s business model from Upwork’s. For example, Fiverr offers a first-of-its-kind way of buying and selling services through its platform in which sellers must charge by the job, not by the hour — in doing so, it makes the browsing experience similar to that of buying on Amazon or Walmart, which buyers and sellers both seem to greatly appreciate. This differs significantly from Upwork, where buyers pay sellers by the hour like more traditional freelancing services. Additionally, sellers on Fiverr post their gigs and wait for them to be scooped up by buyers, unlike Upwork who, again, focuses on the more traditional way of freelancing in which buyers post job listings for freelancers to bid on.

While these may seem like tiny differences, they have a huge impact on Fiverr’s business model and has thus far proven to be their competitive advantage. The similarities to traditional eCommerce stores make Fiverr’s digital marketplace incredibly low-friction and provides seamless integration between buyers and sellers, leading to an unprecedented user experience on both ends of each transaction. This is what Fiverr calls “productized services” — this is what sets them apart from competitors and allows sellers to quickly scale their business and following.

These “productized services” are what truly makes Fiverr’s marketplace unique, effectively reducing risks on each side of the transaction when compared to traditional freelancing. To quote my friend Mukund Mohan,

Fiverr’s “productized services” create a fixed deliverable at a fixed price.

Alright. That was a whole lot of writing without the incorporation of any diagrams, charts, or graphs — I know, very unlike me. Since I believe numbers and statistics tell stories quicker and more completely than words ever could, allow me to compare Fiverr and Upwork through a few meaningful tables and graphs.

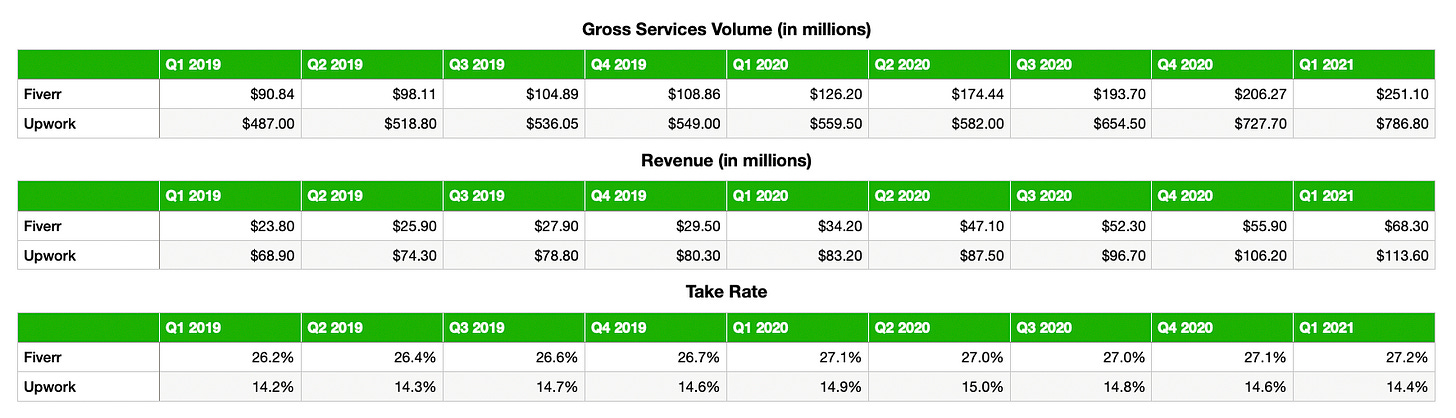

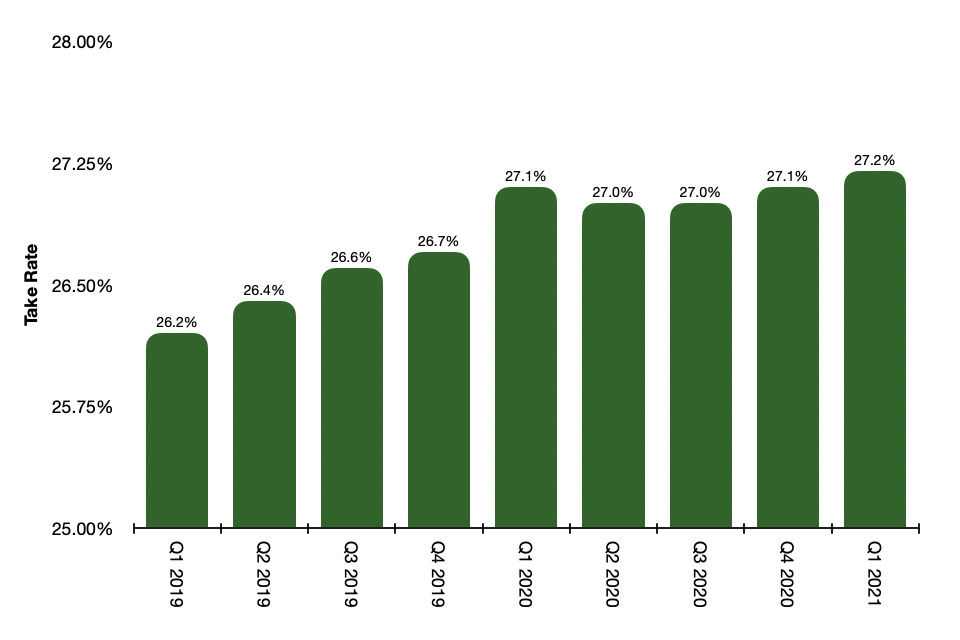

Let’s take a look at this table that outlines each company’s respective gross services volume (GSV), revenue, and take rate (derived by dividing revenue from GSV).

Just by taking a quick look at each company’s numbers we can see some notable differences in terms of growth:

Fiverr’s GSV grew by 89.5% in 2020, compared to Upwork’s growth of 32.6%.

Fiverr’s revenue also grew by 89.5% in 2020, compared to Upwork’s growth of 32.3%.

Fiverr’s take rate grew by 3.8% from Q1 2019 to Q1 2021, compared to Upwork’s growth of just 1.4%.

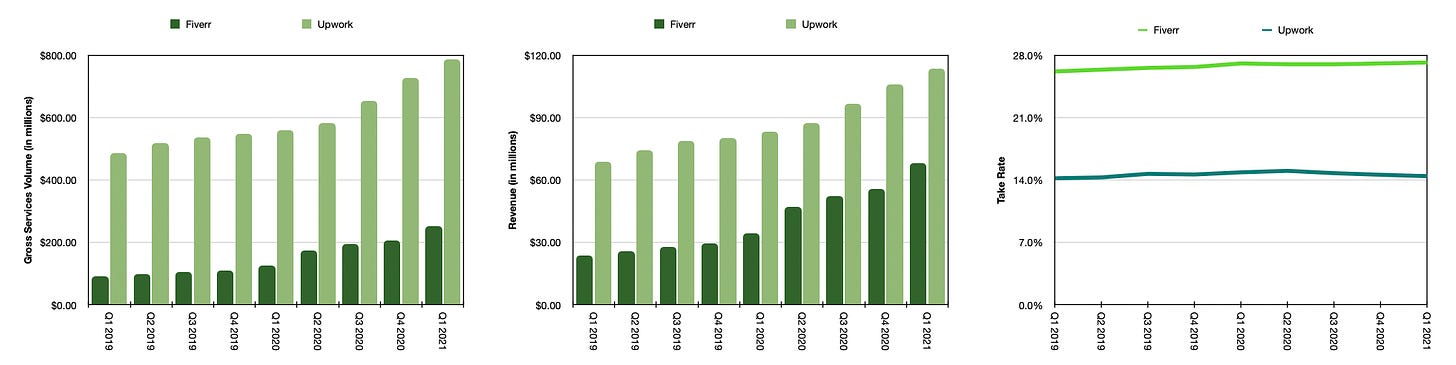

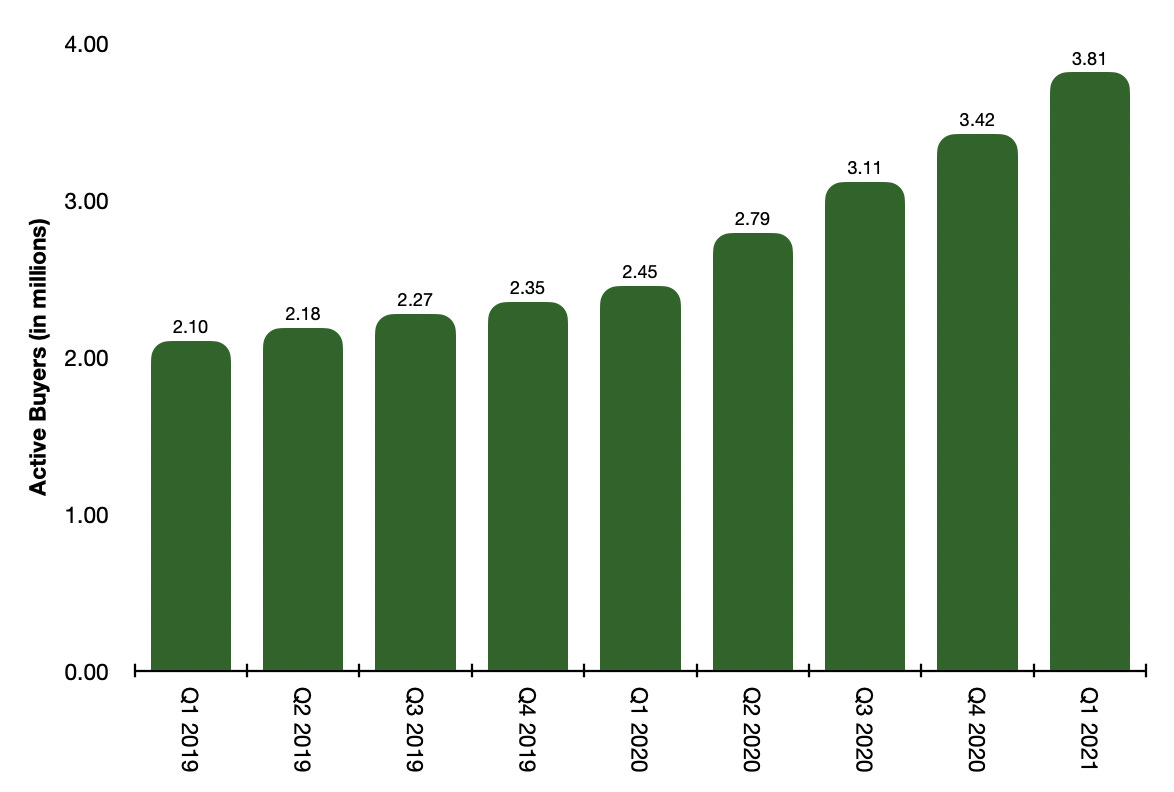

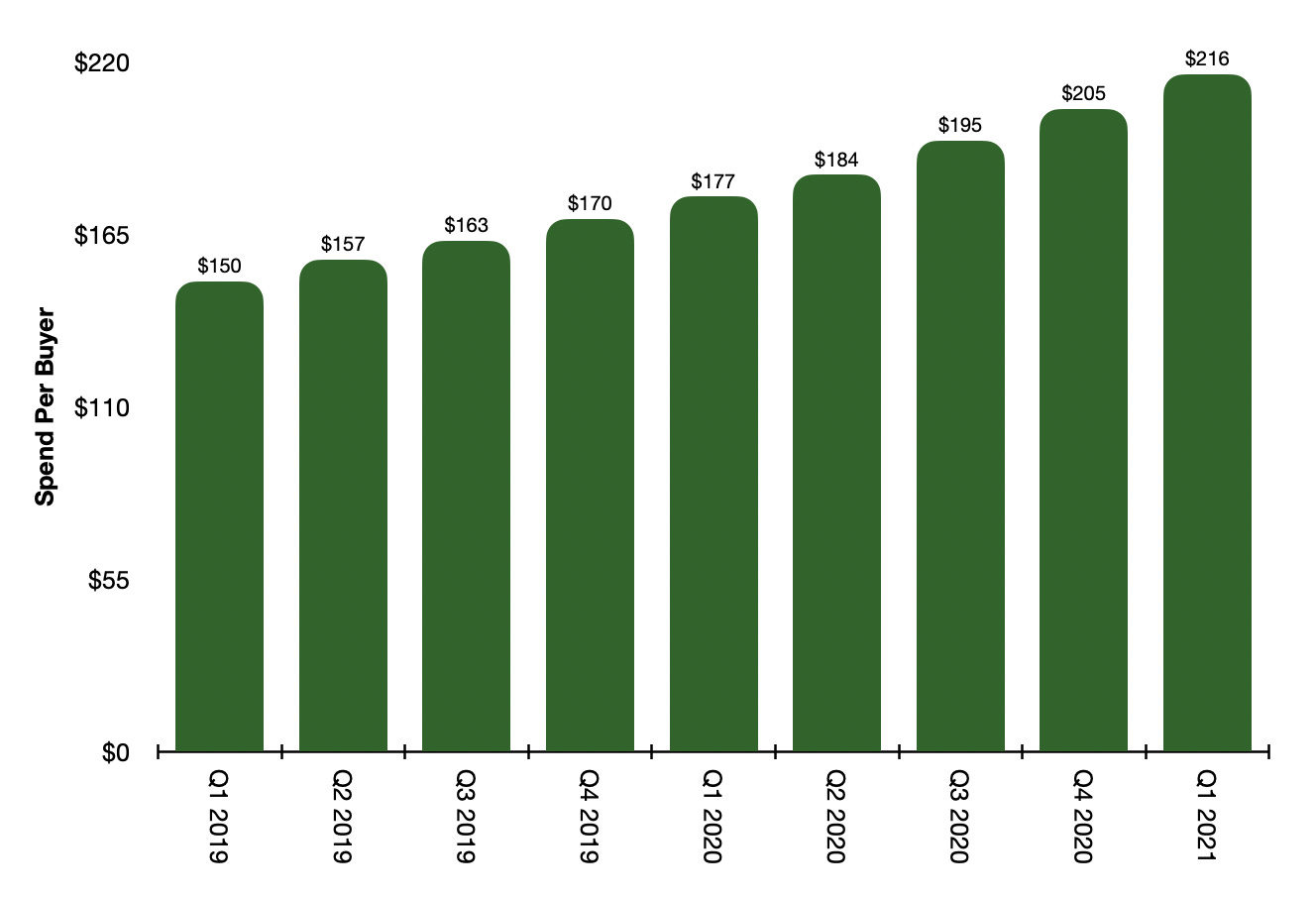

Here are the graphs I promised — these should be a good visual aid of both companies’ respective growth over the past nine quarters as well as their difference in take rates.

Using these numbers, allow me to paint a picture:

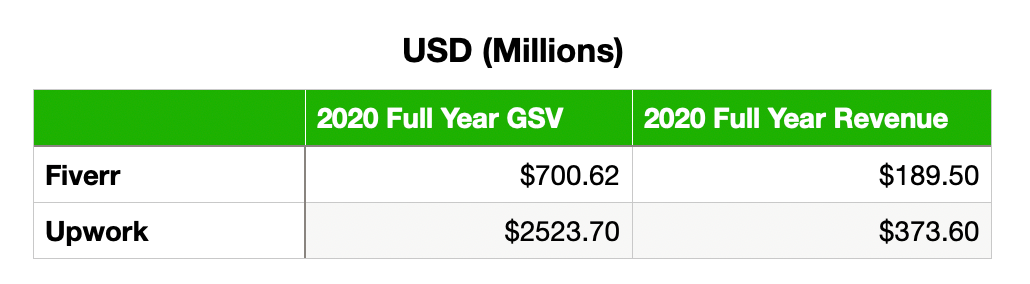

In 2020, Fiverr’s GSV totaled to $700.6M in comparison to Upwork’s GSV of $2.52B.

Likewise, Fiverr’s 2020 revenue was $189.5M while Upwork’s revenue was $373.6M.

My point here is this:

Despite Fiverr having a GSV over 3.5x smaller than Upwork, Fiverr’s take rate has allowed them to earn more than half of Upwork’s total revenue.

This is an incredible statistic. This means that Fiverr needs to be just over half the size of Upwork to earn the same amount of revenue.

Of course, this is all thanks to Fiverr’s revolutionary “productized services” that allow them to enact their eCommerce-style business model. Buyers and sellers alike enjoy this model so much that they sacrifice nearly thirteen combined percentage points (in terms of take rate) just to use Fiverr’s model instead of Upwork — and they keep on coming. In 2020, Fiverr’s active buyers reached 3.4M accounts, posting a growth of 45% year-over-year.

This is what sets Fiverr apart from the crowd. This is Fiverr’s moat.

Slowly but surely, Fiverr is closing the gap and changing freelancing forever.

That said, there are plenty of players in the landscape, all of which offer somewhat similar services. Thus, there are little to no switching costs for freelancers, which leads to an ultra-competitive industry. Despite how it sounds, this is a good thing — for any one player to come out on top, continuous innovation and strategic acquisitions are needed.

Let’s remember:

This isn’t Micha Kaufman’s first rodeo.

Fiverr is a technology company at heart.

8. Financials

Finally, it’s time for my favorite part of every essay I write — an in-depth look into some defining metrics that makes Fiverr what it is today. Like always, we will assess key financial figures from Fiverr’s income statement and balance sheet, as well as some statistics that don’t necessarily make their way onto either financial statement but are worth recognizing.

However, before we begin, let’s quickly cover the basics.

Fiverr currently trades at $211.41 with a P/S of 33.88 and a forward P/E of 192.19 — these ratios are understandably high, as Fiverr has run up 239% over the past year. To get a better idea of Fiverr’s valuation, let me quickly compare them to a couple other popular growth stocks:

Square — up 143% over the past year with a P/S of 8.16 and a forward P/E of 112.44

Roku — up 200% over the past year with a P/S of 22.96 and a forward P/E of 326.20

Pinterest — up 226% over the past year with a P/S of 24.44 and a forward P/E of 56.26

CrowdStrike — up 144% over the past year with a P/S of 54.53 and a forward P/E of 344.73

Everyone values companies differently, so I’ll leave it to you decide where Fiverr stands amongst the crowd.

Now that we got that taken care of, let’s dive in.

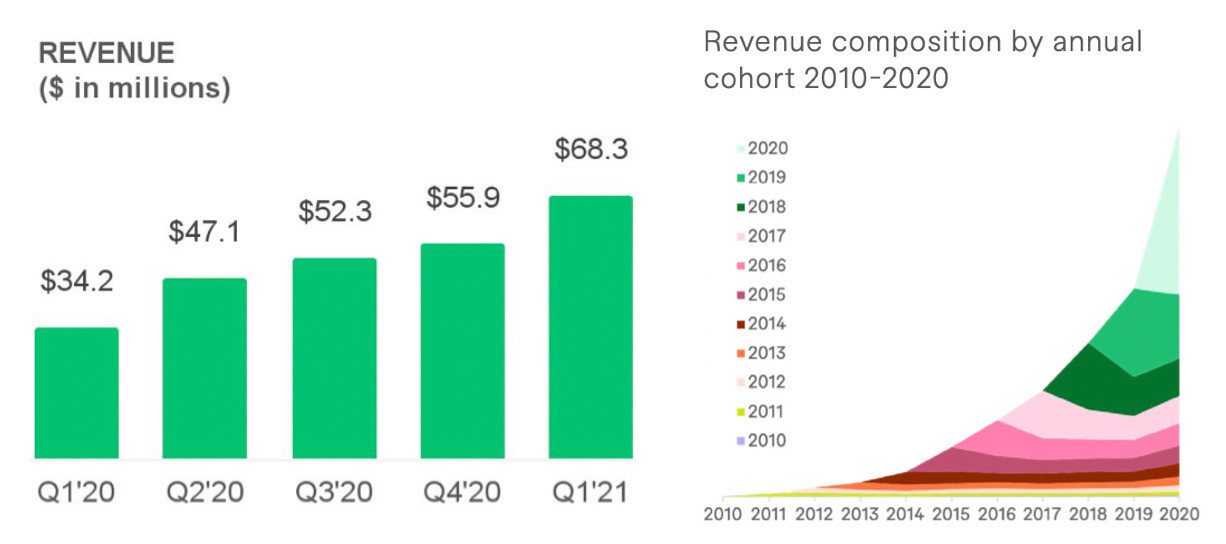

a) Income Statement

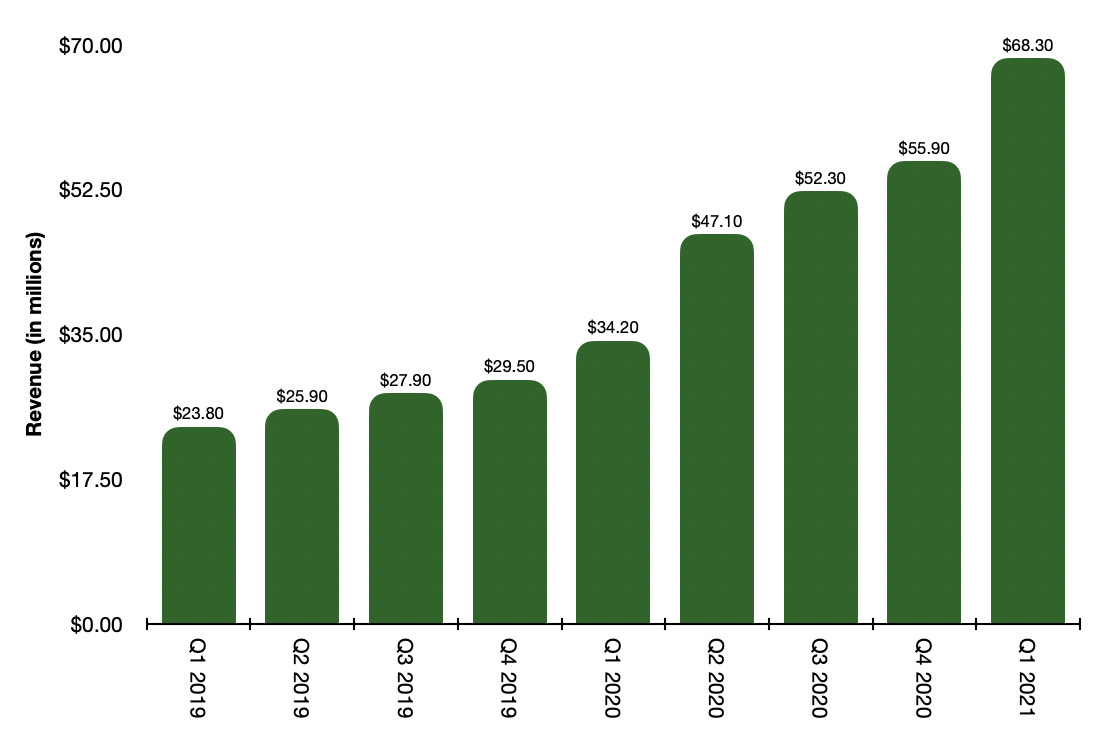

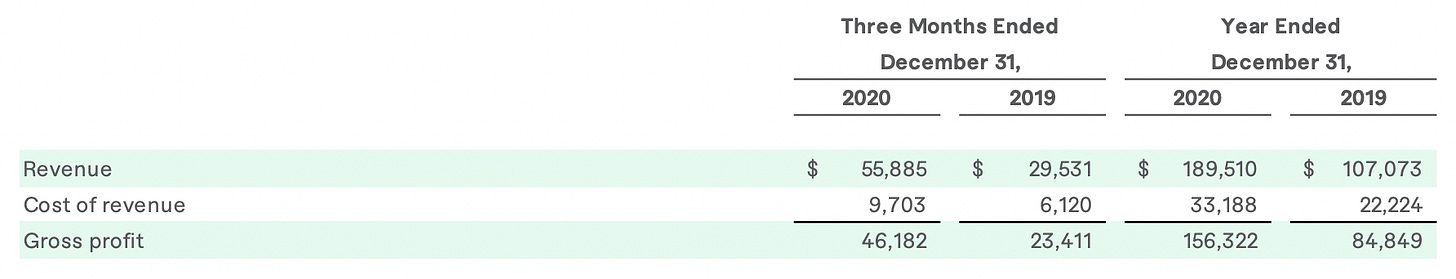

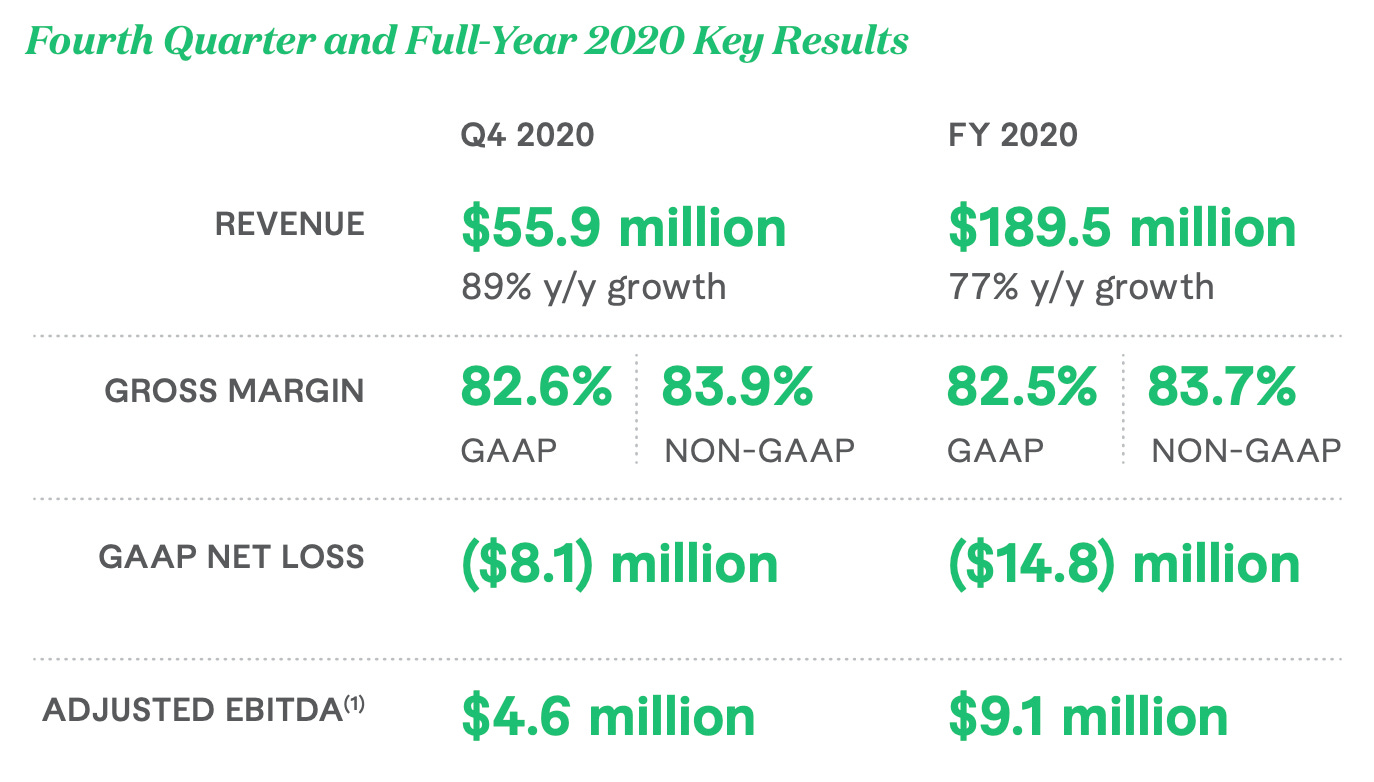

In 2020, Fiverr’s year-end revenue grew to $189.5M, as mentioned earlier, which represents a year-over-year growth of 77%. The company then posted revenue of $68.3M in Q1 2021 (a 100% increase year-over-year) and estimate full-year revenue of ~$305M, which would be a 61% increase from the prior year.

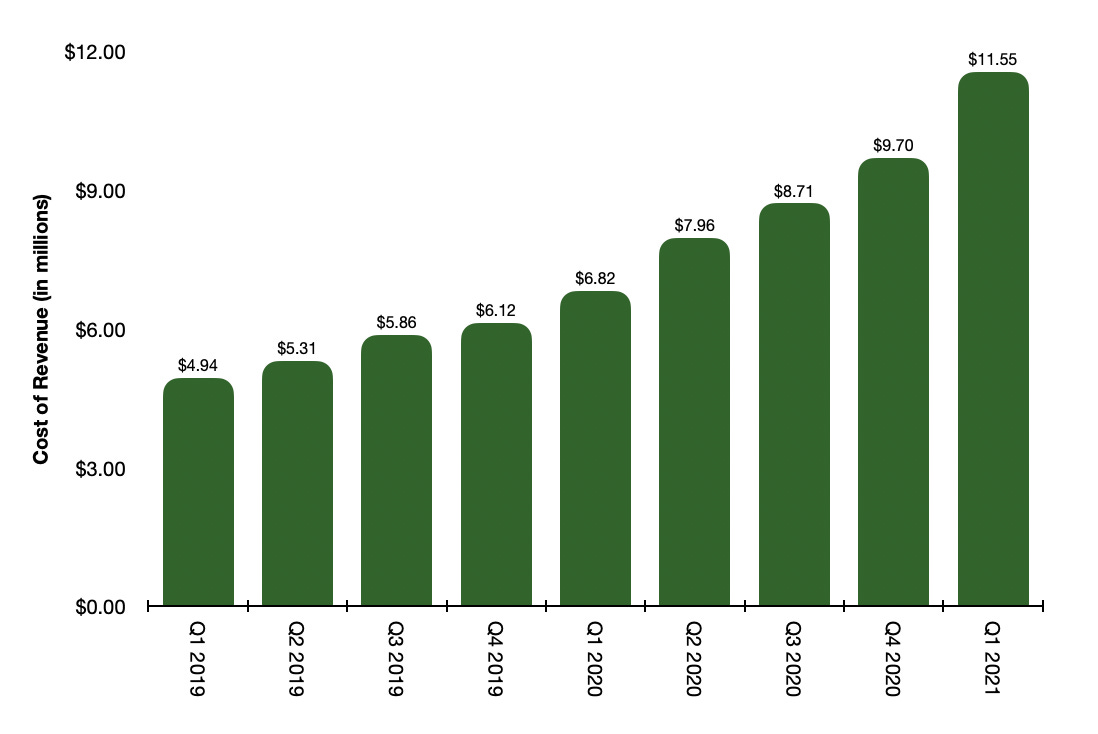

On that same note, Fiverr’s cost of revenue also continues to increase. In Q1 2021, Fiverr’s cost of revenue reached a new high of $11.55M, a 69.4% increase year-over-year. Here is a chart outlining Fiverr’s cost of revenue over the past nine quarters.

This steady increase in cost of revenue is to be expected for a company growing at the rate Fiverr is, and should not be of concern.

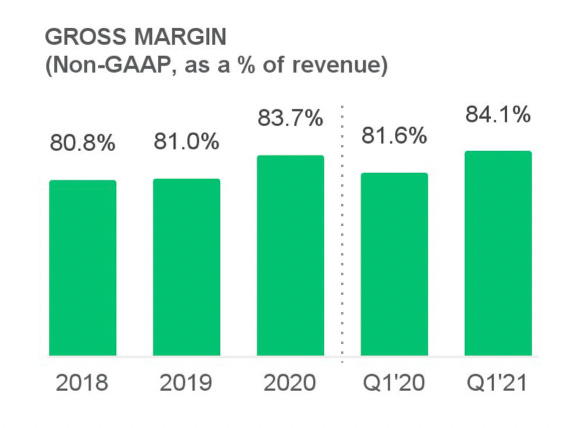

Perhaps Fiverr’s most impressive financial metric, however, is their gross margins. In 2020, Fiverr’s gross margins increased 260bps year-over-year to a whopping 83.7%. Incredibly, Fiverr improved this number in Q1 2021 by adding 20bps from Q4 2020, propelling their gross margin percentage a new quarterly high of 84.1%. At their current rate of improvement, gross margins of 85% for FY21 is not out of the question.

Remember Fiverr describing themselves technology company powered by a Service-as-a-Product business model? This is the reward they reap.

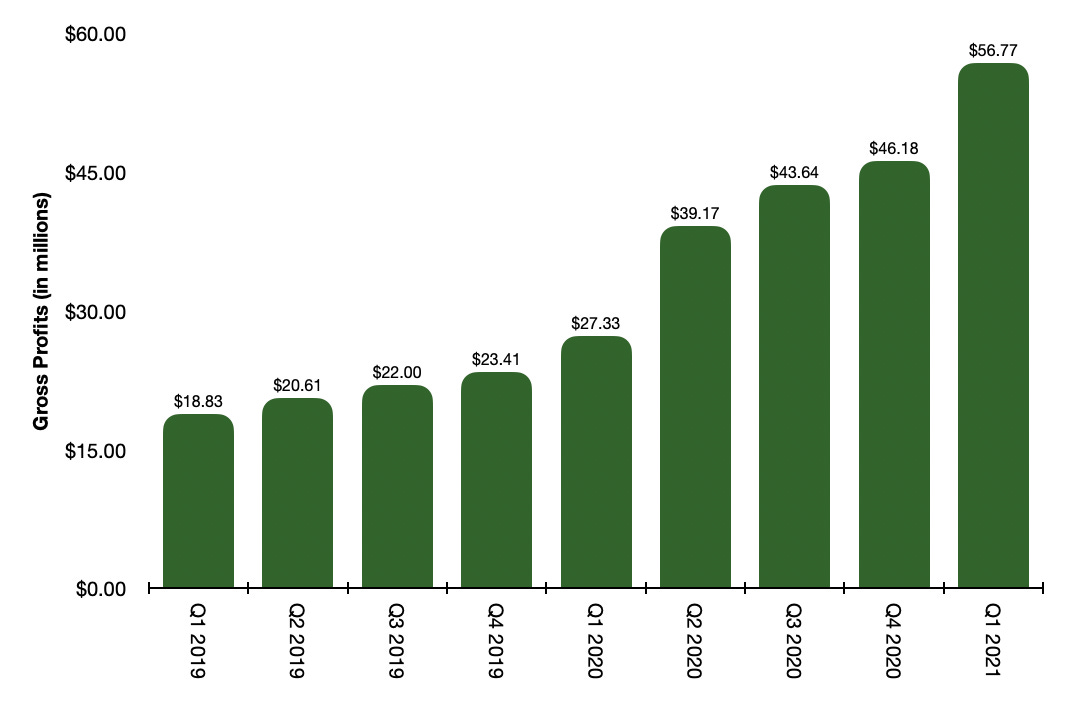

Next, let’s glance over Fiverr’s gross profits. In 2020, Fiverr posted gross profits of $156.3M — nearly doubling 2019’s profits of $84.8M. Along with revenue and cost of revenue, Fiverr’s profits have continued to increase quarter-over-quarter, with the company reporting gross profits of $56.8M in Q1 2021 (a 22.9% increase quarter-over-quarter and a 108.1% increase year-over-year).

You don’t need to be a statistician to see the bump in profits that Covid-19 provided Fiverr for the past four quarters — the only question is whether or not it is sustainable, of which time will tell.

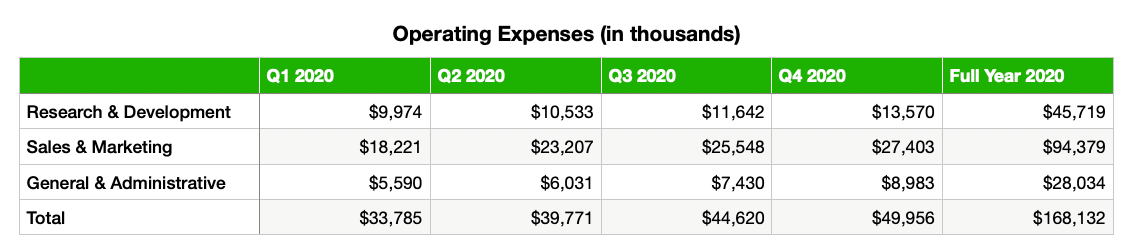

Lastly, let’s go over Fiverr’s operating expenses. Like any strategic “growth” company, Fiverr bets on themselves — this is evident by their operating expenses. In 2020, the company accumulated $168.13M in operating expenses (a 40.58% increase from the $119.6M they spent in 2019). Operating expenses are broken down into three categories: research and development, sales and marketing, and general and administrative. Below is a table with the corresponding amount spent in each category during the past fiscal year.

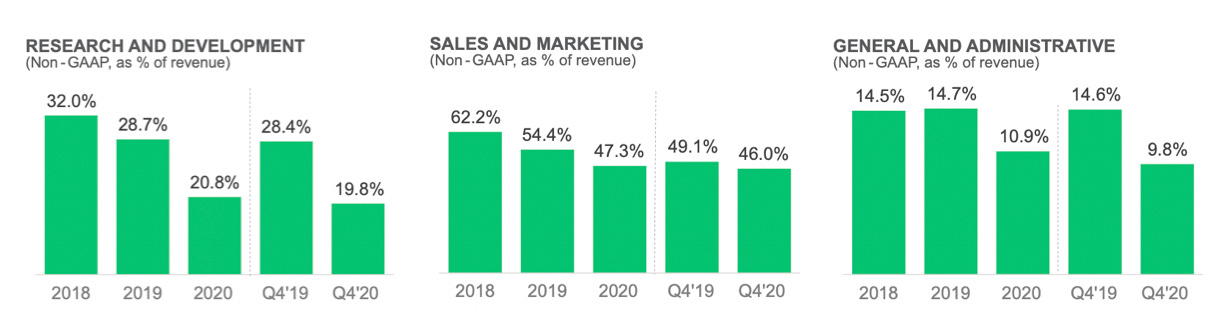

Additionally, here is a graphic (courtesy of Fiverr’s Q4 2020 ER) outlining their operating expenses as a percentage of revenue.

Fiverr achieved quarterly adjusted EBITDA profitability for the first time in the company’s history in Q2 2020 and finished 2020 with an adjusted EBITDA of $9.1M. However, since becoming a public company, Fiverr is yet to report a quarterly (or yearly) GAAP net profit. Below is a screenshot of Fiverr’s Q4 2020 ER.

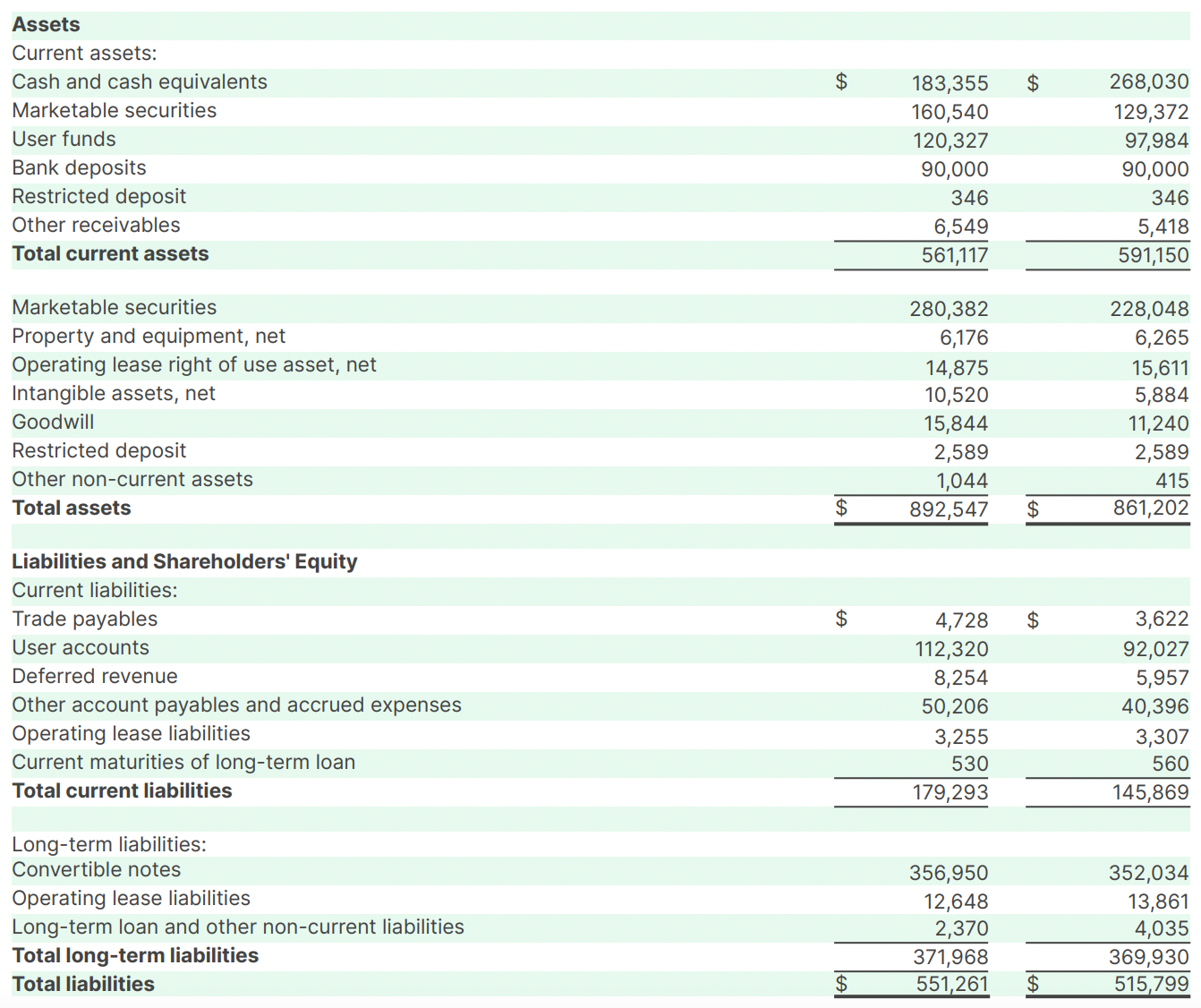

b) Balance Sheet

Traditionally speaking, there isn’t much exciting about balance sheets — that said, let’s quickly skim over Fiverr’s. As of Q1 2021, the company currently has:

$561.12M in current assets

$892.55M in total assets

$179.29M in current liabilities

$551.26M in total liabilities

Above is a screenshot from Fiverr’s Q1 2021 earnings report. As we can see, Fiverr has the cash on hand necessary to make acquisitions and continue operations safely for the time being, with current assets outweighing current liabilities by more than threefold.

c) Useful Operating Metrics

Fiverr has three key performance metrics:

active buyers

spend-per-buyer

take rate

Let’s discuss them in order.

In 2020, Fiverr’s active buyers reached 3.42M, up 45.3% from 2019’s year-end total of 2.35M. Additionally, Fiverr added nearly 400,000 new active buyers in Q1 2021 — their most ever in a single quarter — bringing their current total to 3.81M.

Maybe the exponential curve we see beginning to take shape will continue, maybe it won’t. Time will tell.

Fiverr prides themselves on their ever-increasing spend-per-buyer, and rightly so. In Q1 2021, Fiverr reported an all-time high in spend-per-buyer, reaching $216 — that’s an increase of 22% year-over-year and 5.4% quarter-over-quarter.

Wow, talk about consistency. Also, notice how spend-per-buyer didn’t receive the Covid-19 boost like many other metrics did — this is because spend-per-buyer has nothing to do with the number of active buyers on the platform, but has everything to do with the platform itself. This all circles back to Fiverr’s business model.

Lastly, let’s quickly look at Fiverr’s take rate. Since I already went into some detail about their take rate earlier (in the competition segment of this essay), I’m just going to leave you with a chart of Fiverr’s take rate for the past nine quarters, which outlines their progression.

This is one of the few areas within Fiverr of which I am not sure how much room for improvement remains available — there must be a sweet-spot somewhere. If Fiverr has too high of a take rate, growth in active buyers will slow; too low and they will be operating inefficiently. I’m sure they will triangulate this sweet-spot with time.

9. Critics

I was unable to find a single short-report on Fiverr — that’s not saying there isn’t one out there, just that I never came across one. Thus, I will quickly cover Fiverr’s short interest and propose a couple risks/obstacles that the company may encounter. Let’s get to it.

At the time of writing, Fiverr has 35,840,000 shares outstanding with a float of 27,650,000 shares. Of those 27.65M shares, 1.61M shares are currently being shorted, equating to 5.82% of the float — this is down from 8% from last month when 1.75M shares were being shorted (or 6.33% of the float).

As with any company, there are risks associated to being an investor in Fiverr. Let’s go over a couple concerns/strategies that are crucial to the growth of Fiverr for coming years.

Covid-19 provided Fiverr with an unsustainable boost.

There are many ways to look at how Covid-19 may or may not have affected Fiverr from an operational standpoint. Personally, I don’t see 2020 as an outlier; I see it as a catalyst.

Covid-19 showed the entire world that in many industries remote work is absolutely possible — not only is it possible, but it’s also reliable, flexible, efficient, and, in some cases, just downright more enjoyable. Last year, more people worked from home than ever before in all of human history — something tells me that at least a small fraction of those people may not want their stint with remote work to end.

Fiverr is predominantly used by people from the United States.

This is true. But, like all great, founder-led companies, Fiverr is incredibly ambitious. The company has long made it clear that they are not satisfied with operating in just the United States and intend to push boundaries and broaden their horizon by expanding into international markets.

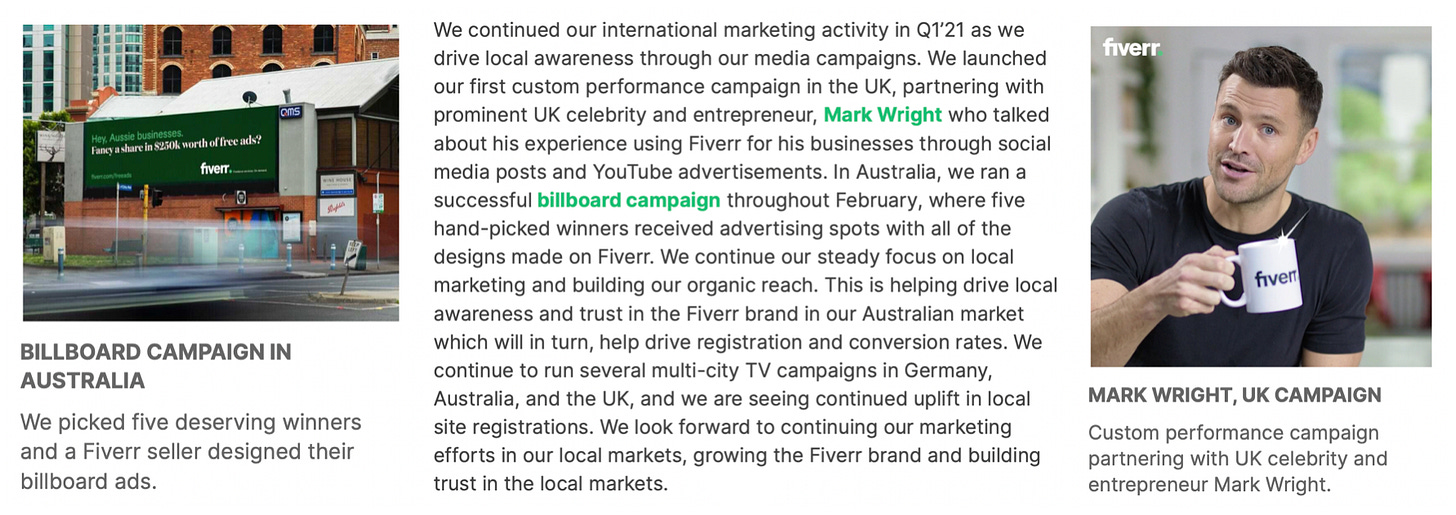

This plan is already being put into effect — currently, Fiverr’s website supports English, Spanish, French, Dutch, Portuguese, Italian, and German. Additionally, Fiverr is deploying TV campaigns in the United Kingdom, Australia, and Germany in an attempt to further capture said markets.

Quality of services.

As I pointed out before, I believe that you get what you pay for in life. That said, I’m not necessarily referring to this risk in that same aspect — rather, I am referring to the services provided.

In 2015, Fiverr settled a lawsuit with Amazon in which the latter claimed that there were sellers on Fiverr offering services in which they would fraudulently rate products on Amazon, boosting reviews and ratings. While I can’t believe that people actually pay for such services, something like this should have never happened in the first place. Since the lawsuit, Fiverr has cracked down on what services can and cannot be listed, though there are still some questionable services that remain available on the site.

This is an area I hope Fiverr improves upon in the future.

10. Points of Emphasis

As per usual, there is a lot more information covered in this essay than I had initially planned on. I get carried away when writing sometimes — sue me. That said, allow me to outline some key points of interest that I want to reiterate:

In 2020, Fiverr’s year-over-year revenue increased by 77% and is estimated to grow by 61% in 2021. Likewise, gross profits increased 84% year-over-year as Fiverr added 260bps to their gross margins, which stood proud at 83.7% as of year-end.

Fiverr is adding active buyers at an impressive rate despite having an industry-leading take rate of roughly 27% — a true testament to the power of their business model. Comparatively speaking, Fiverr’s take rate is nearly double that of main competitors.

Fiverr’s seamless, low-friction, high-trust transactions are preferred by buyers and sellers alike. Their SaaP digital marketplace provides “productized services” and is akin to that of Amazon, creating a pleasant shopping experience unlike traditional freelancing marketplaces.

The number of freelancers in the United States is projected to reach over 86M by 2027, which would equate to roughly half of the U.S. workforce.

Fiverr estimates that its current total addressable market (TAM) is roughly $100B. Fiver currently has a market cap of ~$6B.

Over 70% of hiring managers are considering hiring independent professionals within the next three months, and over 40% of hiring managers predict they will continue using independent professionals well beyond the aftermath caused by Covid-19.

Man, that was a lot of bullet points — perhaps I should sum Fiverr up in one paragraph? Okay, okay… fine, you caught me. Maybe I just want to sum it all up in a paragraph. Like it or not, here it is:

Fiverr is a revolutionary digital marketplace that is completely transforming the freelancing industry, driven by their seamless, eCommerce-like business model. With more professionals switching to independent remote work than ever before, Fiverr is in the driver’s seat for the future of the workforce. If Fiverr is able to capture even a fraction of the growth that the freelancing industry is projected to experience, this company will lend unprecedented returns for investors. Imagining a workforce driven by productized services is far from hyperbolic.

There you have it. I truly hope you found this essay worthwhile — I promise to try to shorten my next deep-dive as I know this has been lengthy.

Before I go, I’d like to offer my sincerest appreciation to Brian Feroldi, Mukund Mohan, and Investor’s Theory for taking the time to proofread and critique this essay. I’m not sure what I have to offer you guys, but I owe you one. Be sure to check them out on Twitter!

If you enjoyed this look into Fiverr’s background and opportunity ahead, please feel free to share — it would really help me out. My DMs on Twitter are always open, and I would love to hear feedback to learn and improve.

As always, thanks for reading! I am wishing each and every one of you all the best on your investing journey.

— Nick

Brilliant one Nick, I thoroughly enjoyed reading it. Will DM you my questions.